Property owners lost more than $3 trillion during the 2008 housing crash. But, with the right real estate strategy, such as buying real estate during a recession, they might have survived the downturn.

The US Inflation Calculator has “inflation at 8.6%.” So, the hopes of passive commercial real estate investing might seem pointless. We beg to differ.

We’ve listened to countless podcasts and read multiple articles about the real estate investing sector’s ability to withstand a recession, but how does this industry surf through the economic wave? Let’s look into why this industry is able to surf through the economic wave.

What Is A Recession?

A recession occurs when a nation’s economy faces negative gross domestic product (GDP), growing unemployment, decreased retail sales, and declining indicators of income and manufacturing over a sustained period. Given the illiquid nature of real estate, it may take months to notice the effect of reducing yields to become apparent. Likewise, in an economic downturn, the impact may stay longer than other asset classes that quickly recover.

The Impact On Commercial Real Estate Properties

The dominating risk element for commercial real estate during a recession is a drop in tenant enterprises that results in unpaid rent. Historically, during recessive economic cycles, companies dependent on discretionary expenditures like shopping, restaurants, and entertainment suffer significant financial losses.

Customers often cut down on spending in these categories to concentrate on the necessities, which are real estate properties that serve essential needs, i.e. Banks, drug stores, medical offices, and multifamily apartments, which tend to be more resistant during these recessionary periods.

Regarding property value, commercial asset types are affected differently in comparison to residential real estate holdings. In residential, homeowners affected by corporate losses and layoffs lose their income, resulting in overdue mortgage payments and even foreclosures. When cases of residential confiscation occur, the result is an oversupply and loss of demand for housing properties.

On the other hand, commercial property values are based primarily on net operating income (NOI) which is calculated from a property’s gross rental income and operating expenses. Buildings that experience declining occupancy, delinquent payments, or the absence of rent payments, decrease the property’s NOI. Thus, reducing the property evaluation’s income method, which as a result decreases the property’s value.

Investing In Commercial Real Estate

As most markets witness a decrease in capital during a recession, real estate still stands as one of the most stable investments proving its recession resilience.

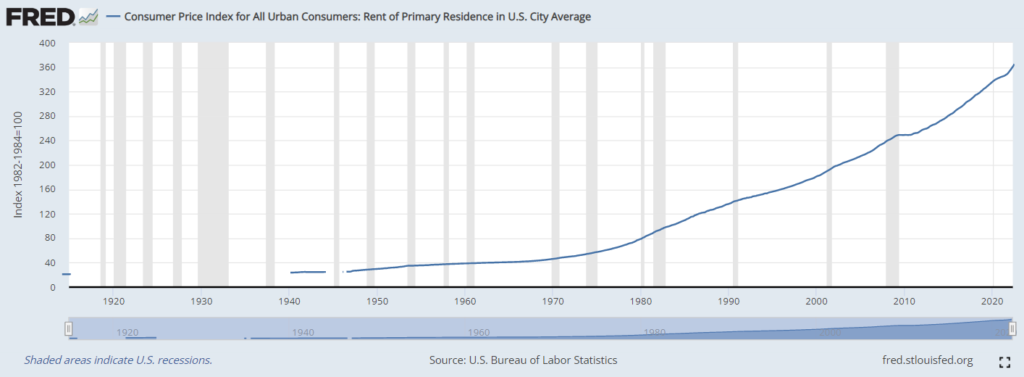

According to the Federal Reserve’s consumer price index, demands for rental residency continue to increase, performing better than most when the economy takes a plunge.

Earlier in the article, we covered CRE properties that thrive based on consumer necessities in the market that prove to be recession-proof during fiscal plummets.

Other assets classes in commercial real estate that are less affected include:

- Multifamily

- Storage Units

- Mobile Home Parks

Investing In Commercial Real Estate: Multifamily Apartment Buildings

Multifamily will continue to be less affected by the recession as the sector continues to prove its worth as a stable cash flow and lucrative venture, especially in areas experiencing population growth. With strong market fundamentals and a track record of resilience during economic downturns, multifamily properties offer investors the opportunity to secure consistent passive income.

During a recession, individuals typically adopt a more frugal lifestyle, cutting back on expenses but still needing a home. As a result, some may downsize, trade their costly homes for affordable options, or shift from a high-end apartment to a more budget-friendly option. This continuous demand cycle is driven by income, lifestyle, and economic factors. Furthermore, those unable to qualify for home purchases turn to the multifamily market for housing, ensuring constant demand for rentals across different property classes. This is why multifamily properties are regarded as positive commercial real estate investments.

Investing in Commercial Real Estate: Self-Storage

Self-storage is proving to be a solid and recession-resistant subsector in commercial real estate, making it an attractive option for real estate investors looking for profitable investment opportunities. While it may not be the most glamorous of commercial properties, self-storage has demonstrated impressive growth and resilience over the years.

During the Great Recession, all commercial real estate segments experienced a net annual loss of anywhere between 25 to 67%, except for self-storage, which posted a gain of 5% in 2008. This is one of the reasons why self-storage has become a popular investment option for real estate investors looking for a safe haven in uncertain economic times.

Self-storage is an ideal investment for real estate investors looking for a flexible asset class that can adapt to changing market conditions. Unlike other asset classes, self-storage has a relatively low break-even occupancy, often as low as 60%, and a relatively quick eviction process for non-paying tenants. These features make self-storage a profitable and low-risk investment opportunity for real estate investors.

Despite these advantages, self-storage is not without its risks. As with any investment, there is always the risk of oversupply and competition in certain markets, which can put pressure on occupancies and rental rates. Real estate investors looking to invest in self-storage must conduct thorough research to ensure that the facility is located in an area where demand is high.

Overall, self-storage is a recession-resistant property type in commercial real estate that provides a profitable investment opportunity for real estate investors. With its flexible nature and low risk, self-storage is an attractive option for those looking for a secure investment with capital gains.

Investing In Commercial Real Estate: Mobile Home Parks

Mobile home parks have emerged as an attractive option for commercial real estate investors looking to diversify their investment portfolios. With concerns of an impending recession, many investors are seeking out alternative commercial investments to protect their portfolios against market volatility.

Mobile home parks have a track record of delivering strong returns, even during economic downturns, making them a sound investment property option for investors. According to Green Street Advisors, operating income from mobile home parks increased by 87% between 2004 and 2018 and remained stable even during the Great Recession of 2008.

One of the significant advantages of investing in mobile home parks is that they provide affordable housing options for low-income individuals and families. With rising rental prices for traditional commercial real estate properties, mobile home parks offer a more affordable alternative, making them an attractive commercial property investment option.

Investing in mobile home parks also offers higher profit margins, with expense ratios around 30%-40%, providing more room for recovery in the event of an economic downturn. Mobile home parks also provide a unique investment opportunity due to their long-term lease agreements, which ensure that residents remain in place for an extended period. This factor provides stability and security for investors looking for a long-term commercial investment.

Mobile home parks are becoming an increasingly attractive investment property option for investors looking to diversify their commercial investments. Despite their management-intensive nature, mobile home parks offer investors a recession-resistant commercial property investment alternative with good downside protection, greater stability, higher margins, and lower expenses. With its affordability, profitability, and stability, investing in mobile home parks provides investors with an excellent opportunity to diversify their investment portfolios.

How to Get Started in Commercial Real Estate Investing

Before starting a commercial investment, there are some questions that should be asked before making the decision on the investment. Jeff Bartel, president and managing director at Hampton & Partners LLC, says it’s important to decide if crowdfunding (syndication deals) is the best way to buy a property. Investors who choose to crowdfinance can also “check their track records for their investment firm,” Bartel adds. … acknowledge all rights and responsibility in regard to withdrawals from investments.

Tips on How to Invest During a Recession

Investing in commercial real estate can be a lucrative way to diversify an investment portfolio, especially during a recession. However, it’s important for investors to have a clear understanding of the market and to follow a few key tips to ensure success.

When considering how or what to invest in, location is crucial. Investors should focus on areas with high demand for rental properties and strong job growth projections. It’s also important to thoroughly research any properties of interest and to pay close attention to the property’s financial history, including cash flow, expenses, and potential risks.

One option for investing in commercial real estate may be to consider real estate investment trusts (REITs). REITs are a type of security that invests in real estate and can offer investors the opportunity to invest in a diversified portfolio of properties without the need for direct property management.

Another option for commercial real estate investors is to purchase a property directly. This requires a higher level of involvement and due diligence, but can offer the potential for higher returns. When purchasing a property directly, investors should focus on properties with stable cash flow and potential for growth, as well as a clear understanding of the financing options available.

Investing in commercial real estate during a recession can also offer unique opportunities, as property values may be lower and there may be less competition from other investors. However, it’s important to maintain a cautious approach and to have a solid understanding of the market.

Bottom Line

Understanding how the commercial real estate market functions during a recession can prove highly profitable when preparing for an upcoming capital raise.

InvestNext is a full-service investment management software that allows you to effectively oversee all aspects of your capital raise in one place. From same-day ACH transactions to waterfall calculations, impress your investors with stylish deal rooms and a clean-cut easy-to-use investor portal.

Schedule a demo today to see how our team can help you to welcome the next level of raising capital.

To learn more about the changes in the market, we frequently update our blogs to provide a knowledge-based resource on real estate trends and terminology.