Debt Funds

Fundraise without limits – raise your way with flexible debt funds. Create promissory note offerings with multiple terms, maturity dates, interest rates, and more.

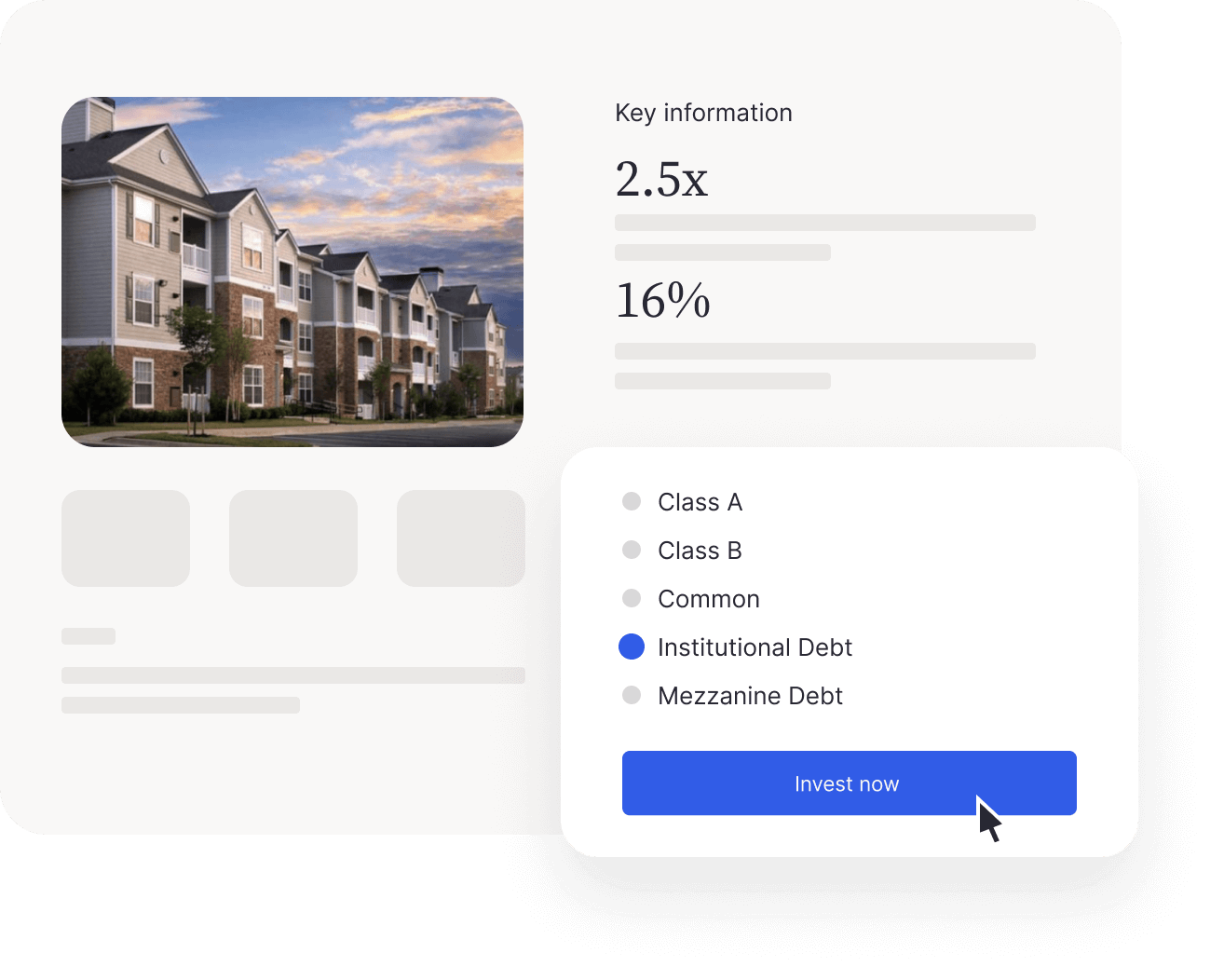

Raise equity, debt, or both in the same offering.

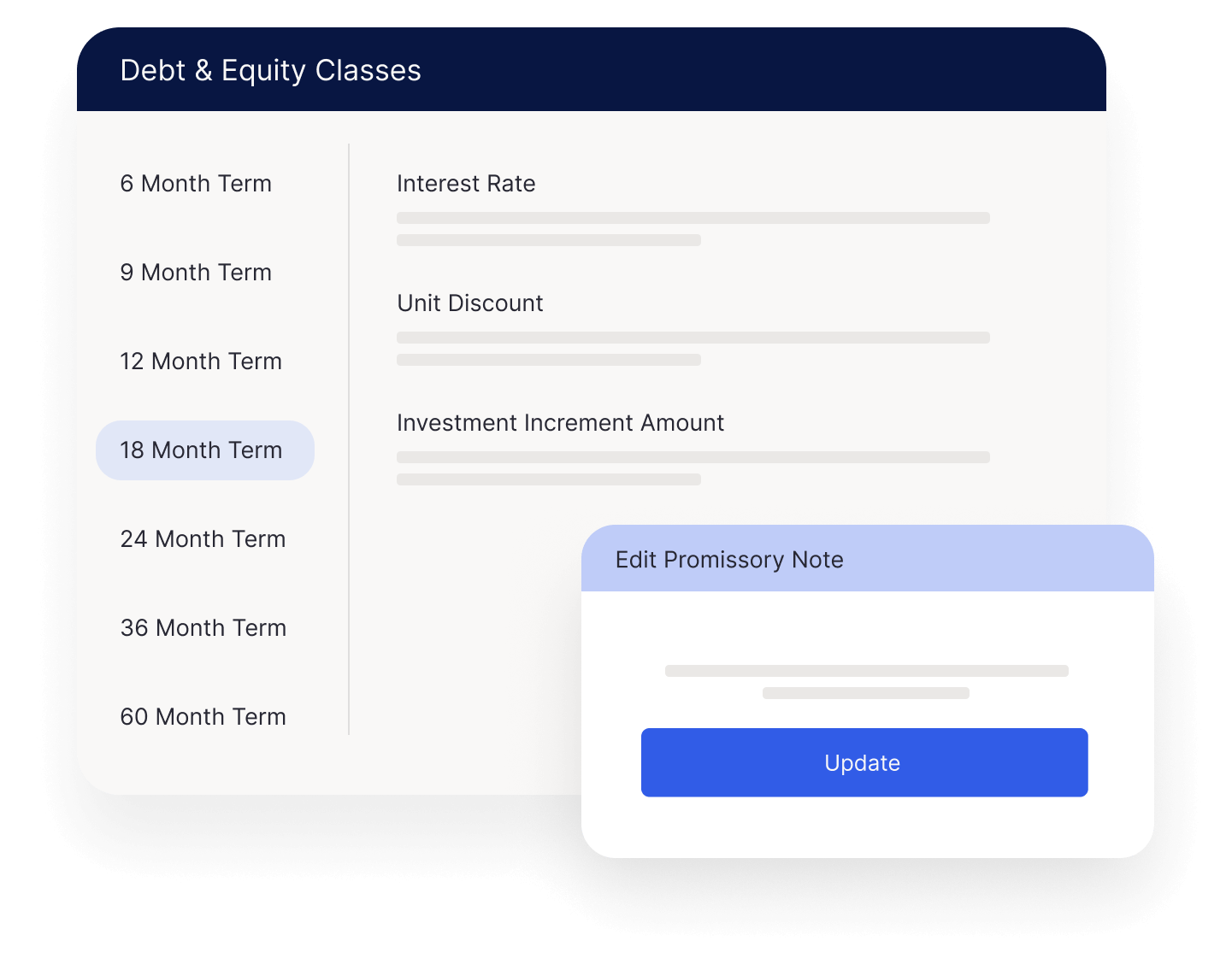

Create your debt offering and offer multiple promissory note classes to your investors in the same project.

Create a seamless investor experience with fully integrated communication tools and automated statements.

Flexible

Your investment management tool shouldn’t limit your fundraising options. Empower your investors with choice in how they invest their capital. Raise equity, debt, or both all within the same offering.

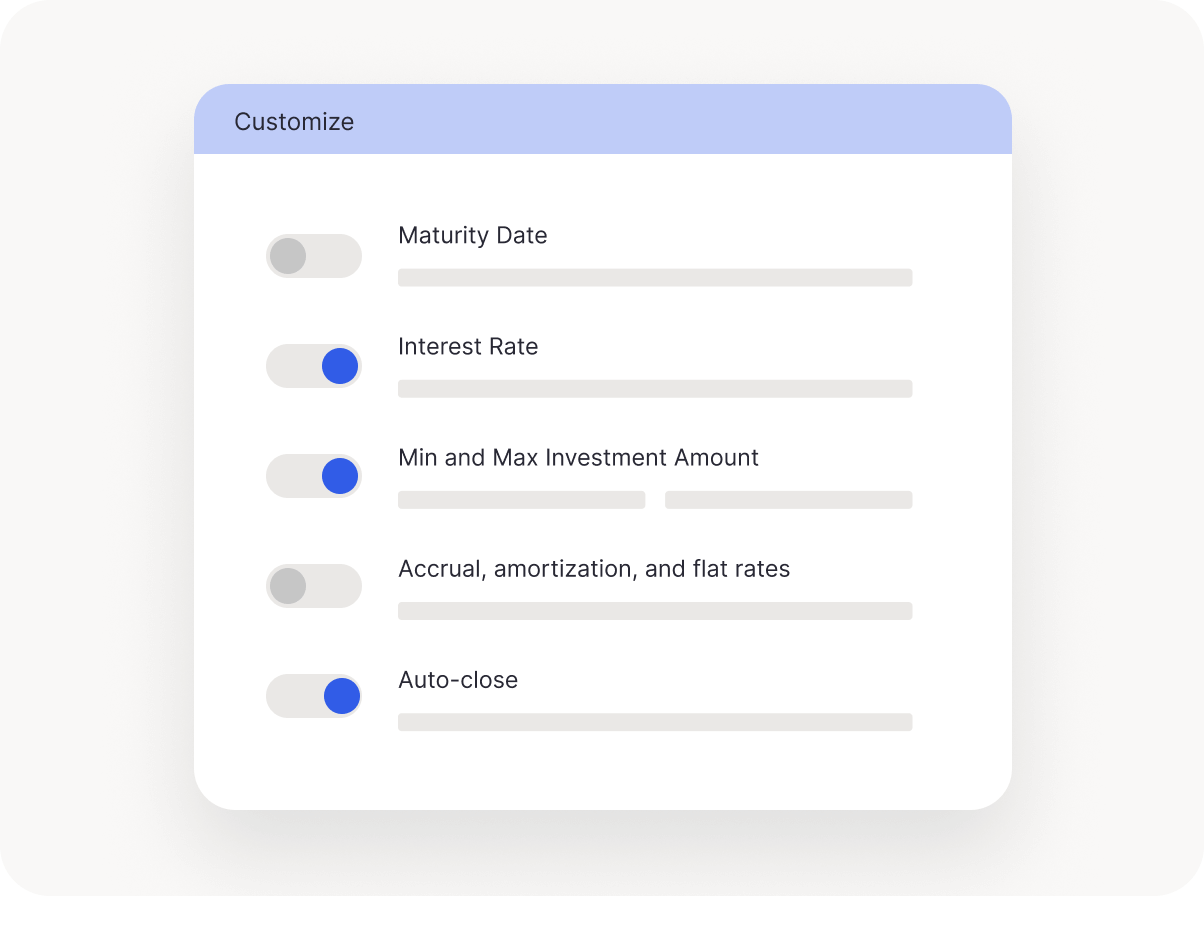

Customized

Customize your debt offering and offer multiple promissory note classes to investors in the same project. Track commitments in your automated back office, powering promissory note payments with the same technology that calculates equity-based distributions.

Configure your offering with options like:

Integrated

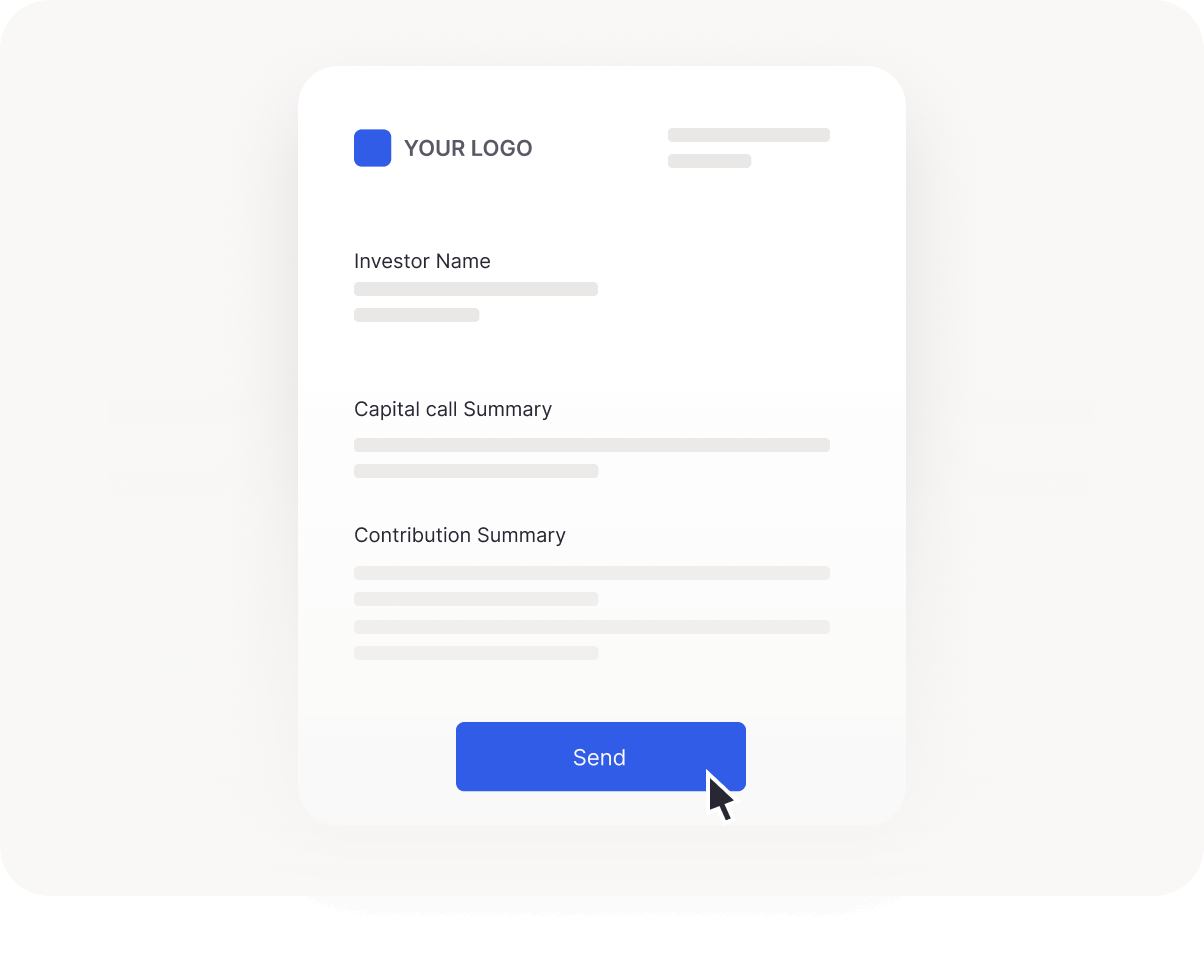

Leverage integrated tools and automations to foster long term relationships with your investors. Dispatch summary statements automatically to build trust and transparency.

“My positive experience with InvestNext was anchored in its user-friendly interface, robust distribution capabilities, cost-effectiveness, and exceptional support.”

Natalia Linchenko | TAG SLC

Create complex distribution waterfalls, automatically calculate distributions and send secure payments to your investors with a few clicks.

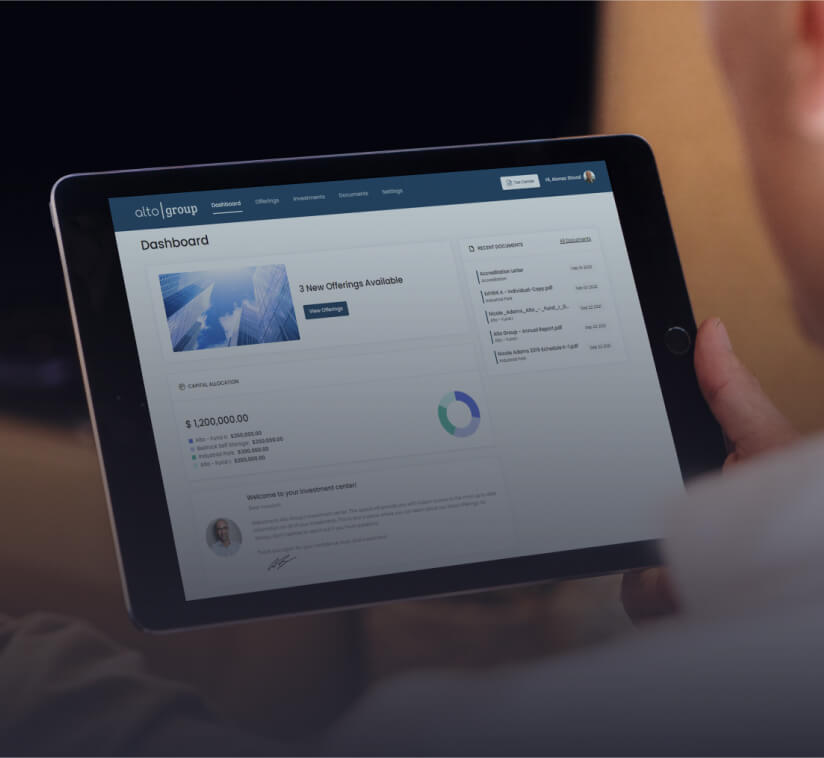

Build credibility and impress your investors with a modern, user-friendly experience. Share documents, send updates, and capture investment intent in a centralized hub.

Reduce administrative overhead with automated financial management.

Our analysis reveals the five strategies reshaping CRE capital raising.

Learn how top fund managers are rewriting the rules of engagement.

Drastically reduce the time it takes to raise and distribute capital.

Transform time-intensive processes into powerful and efficient investor relations tools