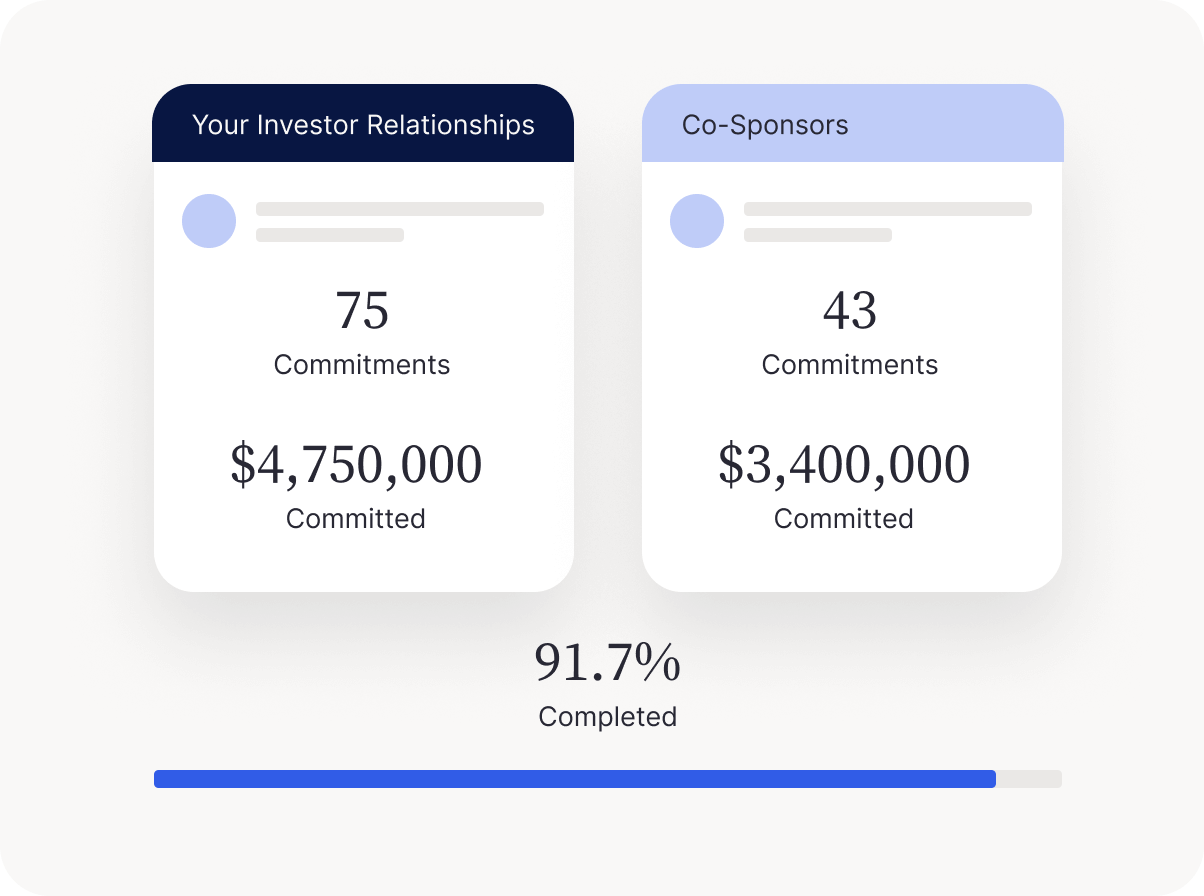

Co-Sponsors

Maintain control of your investor relationships when raising capital with co-sponsors. Enable co-sponsors to raise capital and deliver the same modern investor experience, all without sacrificing your data integrity.

Deliver the same premium portal experience to lead sponsor and co-sponsor investors.

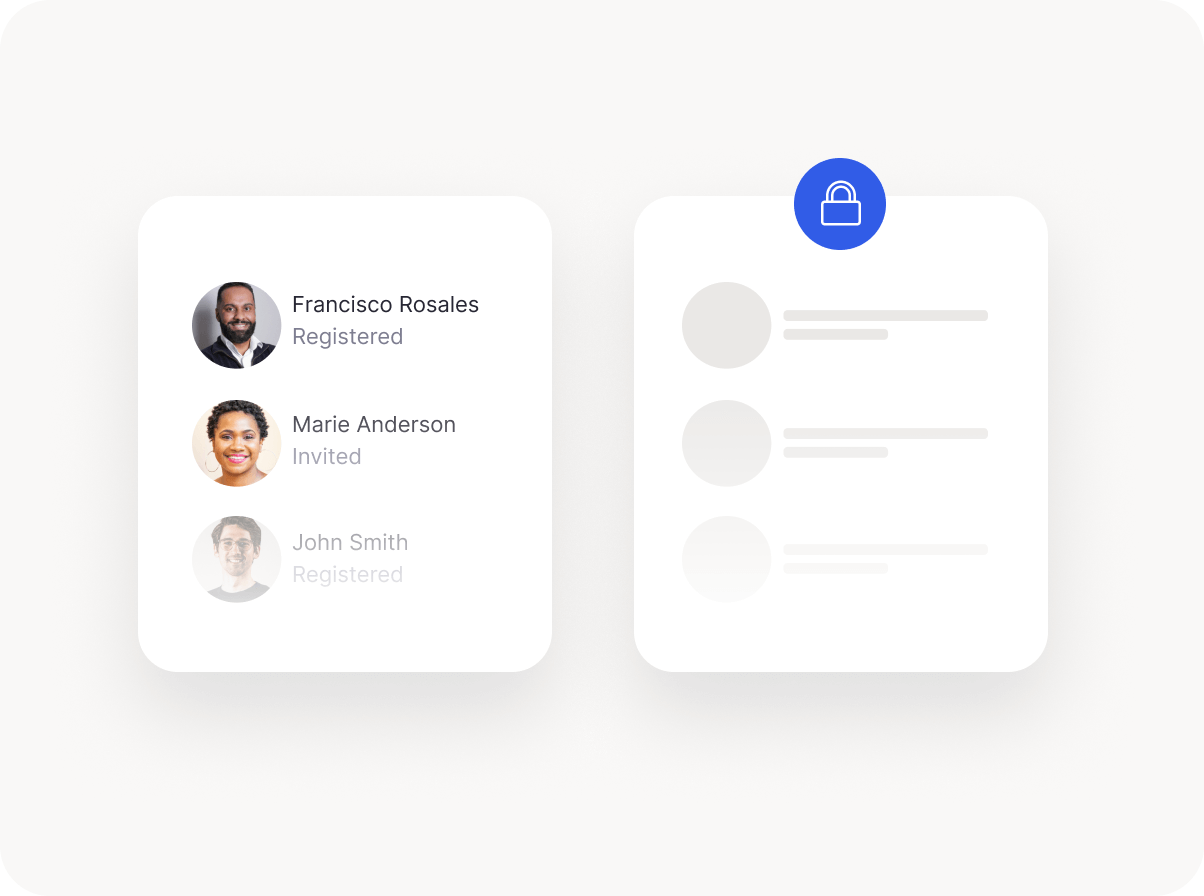

Relationship controls ensure lead sponsors and co-sponsors only have visibility and access to the investors they bring to the deal.

Co-sponsors receive everything they need post-close to manage their investors and distributions.

“Ease of use for sponsors, cosponsors, and investors. It’s widely used and the portal of choice for most sponsors. The Cosponsor 2.0 upgrade has been a game-changer providing limited but valuable visibility to the Sponsor tracking the capital raise progress. Personalized support with an incredible team who take genuine interest and time to know you and your business inside and out.”

Caley Acevez, Director of Investor Relations | Cedar Creek Capital

Fundraise Together

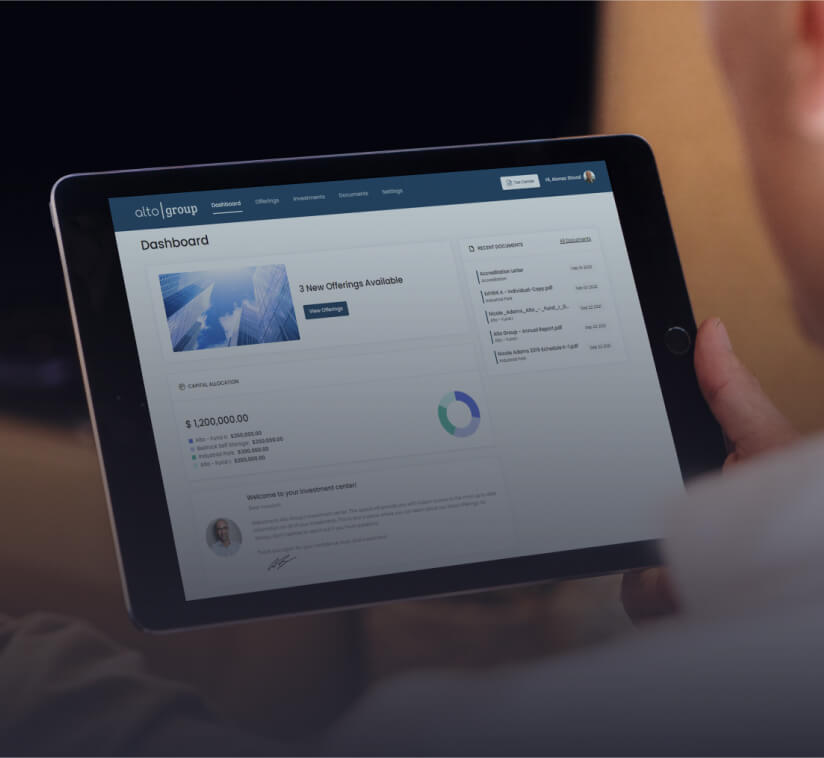

Raise capital with other sponsors without exposing your investor data. Co-sponsors can customize their own branded investor portal and raise capital from their investors with the same industry leading functionality as the lead sponsor.

Protect Relationships

Lead sponsors and co-sponsors get uniquely configured dashboards to ensure your investor data is never exposed. This ensures each sponsor only has visibility and access to the investors they bring to the deal.

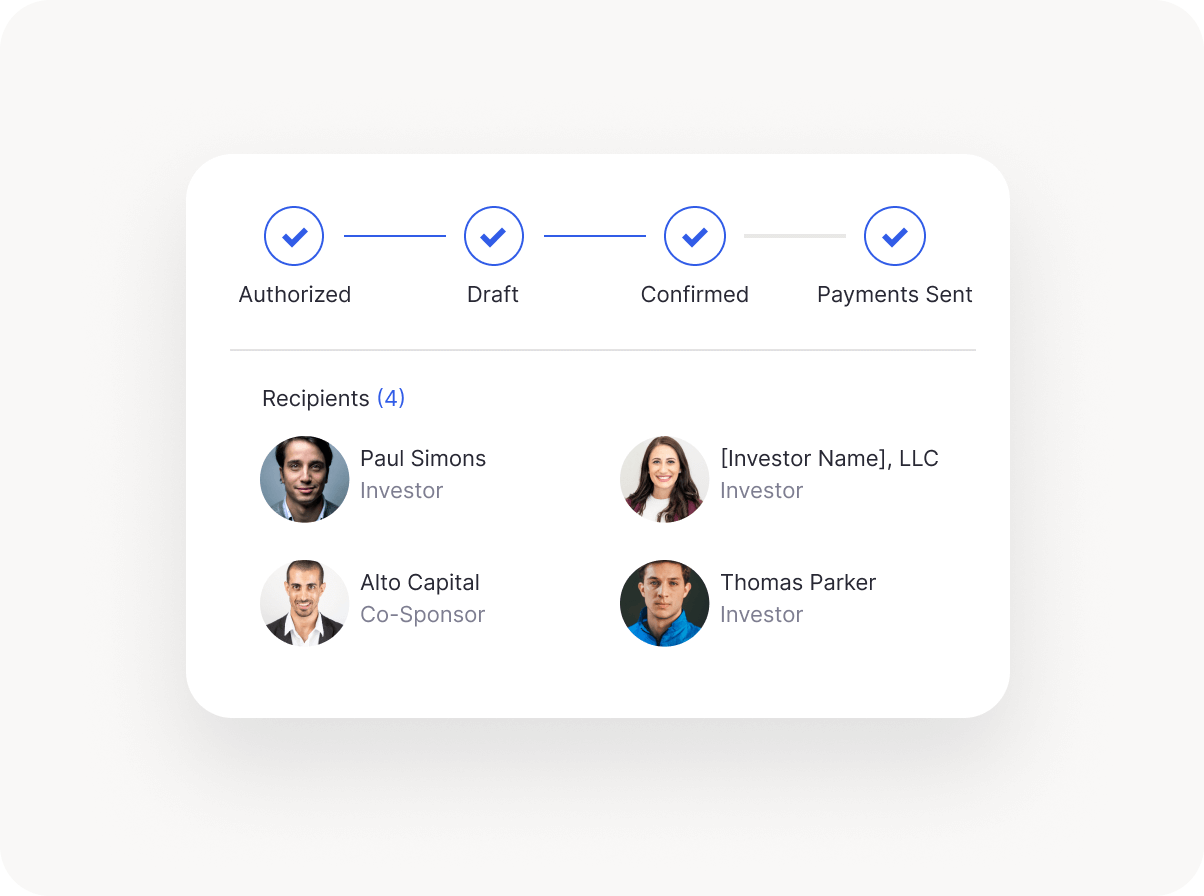

Transition Seamlessly

Eliminate additional work and save time with stress-free hand-offs. Co-sponsors receive everything they need post-close to manage their investors and distributions – without additional actions required from the lead sponsor.

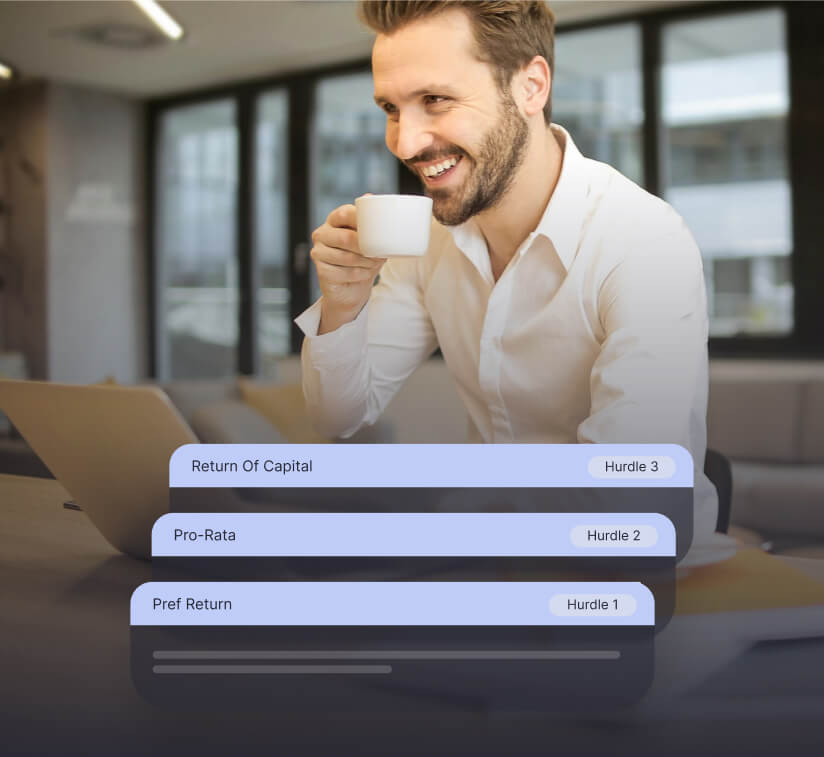

Create complex distribution waterfalls, automatically calculate distributions and send secure payments to your investors with a few clicks.

Build credibility and impress your investors with a modern, user-friendly experience. Share documents, send updates, and capture investment intent in a centralized hub.

Reduce administrative overhead with automated financial management.

Our analysis reveals the five strategies reshaping CRE capital raising.

Learn how top fund managers are rewriting the rules of engagement.

Drastically reduce the time it takes to raise and distribute capital.

Transform time-intensive processes into powerful and efficient investor relations tools