KYC / AML

On average, investors complete verification in less than 1 minute.

Over 90% of investors are approved on their first attempt.

InvestNext’s KYC/AML accepts over 14,000 global ID types.

Fast & Secure

Easy to use for investors, and even easier to manage for sponsors. Investors experience a smooth verification process that doesn’t redirect them outside of your portal or add unnecessary friction to your subscription process.

On average, investors complete verification requirements in less than 1 minute, and over 90% of investors are approved on their first attempt. And with over 14,000 global ID types accepted, you can offer the same great experience to all of your investors regardless of location.

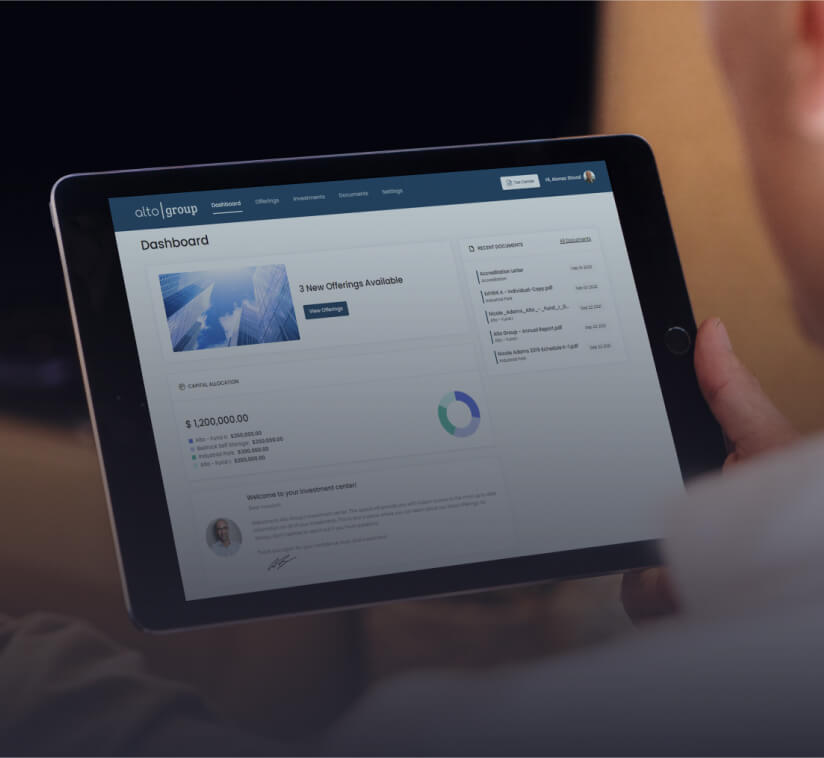

“The introduction of InvestNext reshaped our approach. It came at a critical juncture, providing the scalability we needed to surpass our expectations of $50 million in Capital Under Management, reaching $400 million in Capital Under Management within just four years.”

Mike Williams, VP Investor Relations | Open Door Capital

Keep data secure with the highest industry standards for encryption, data storage, and authentication - verified by the strictest external audit available.

Build credibility and impress your investors with a meticulously designed white label investor portal. Promote offerings to new and existing investors with professional and customizable deal rooms. Accelerate capital raising with frictionless commitment flows and secure inbound funding.

Reduce administrative overhead with automated financial management.

See how integrated KYC/AML offers unparalleled protection – without sacrificing your investor experience.

Our analysis reveals the five strategies reshaping CRE capital raising.

Learn how top fund managers are rewriting the rules of engagement.

Drastically reduce the time it takes to raise and distribute capital.

Transform time-intensive processes into powerful and efficient investor relations tools