Investor Accreditation

Offer greater clarity and reduce the number of investor errors through an intuitive, question-driven accreditation flow.

Empower investors to complete accreditation requirements directly from the investor portal or as a step in your commitment flow.

Empower investors to obtain new accreditation letters, upload existing ones, or self-attest to an existing relationship with your firm.

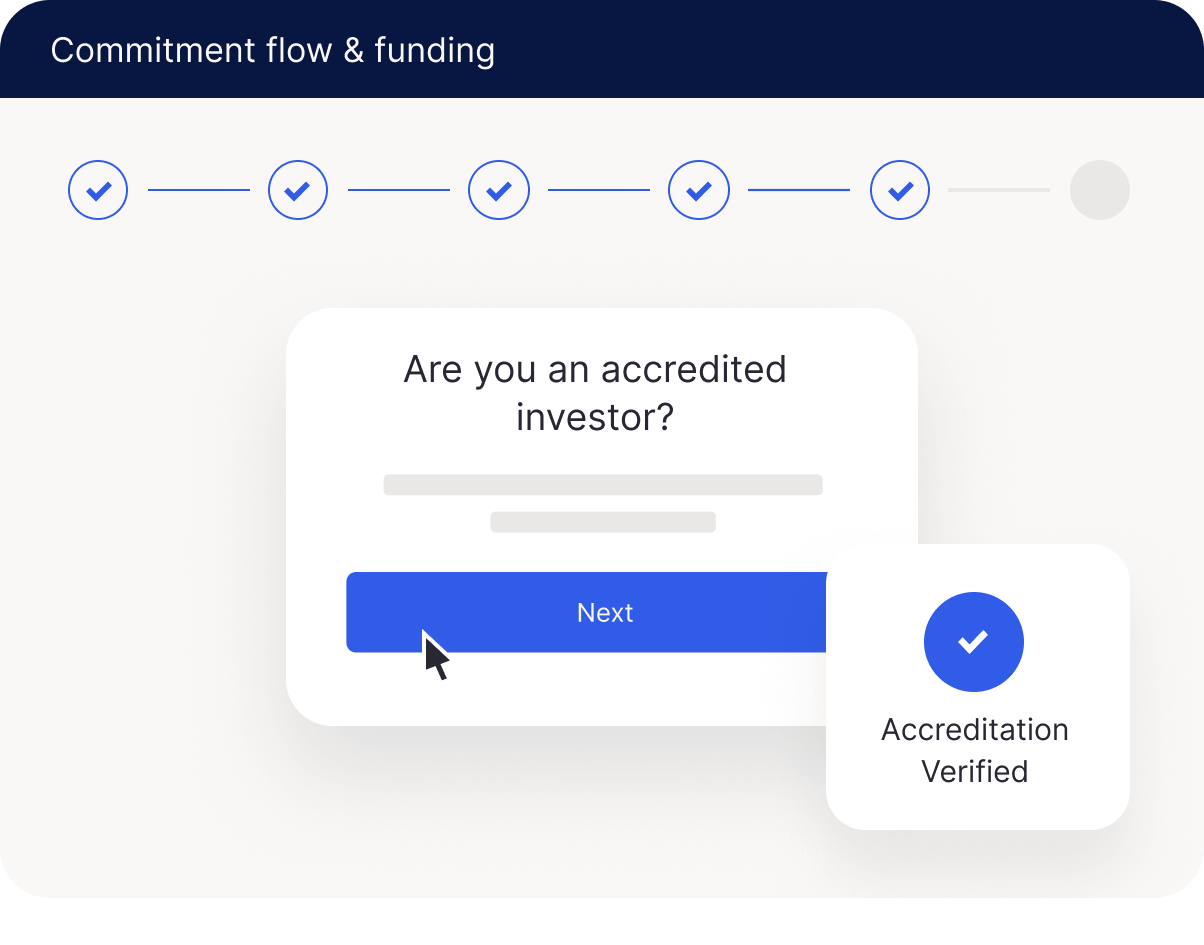

Intuitive

Our uniquely designed, question-based accreditation flow guides your investors through requirements to reduce errors and help you stay compliant.

With greater clarity on document requirements and next steps, you’ll reduce time spent fielding questions and resolving investor mistakes – all while your investors benefit from a straightforward, frustration-free process.

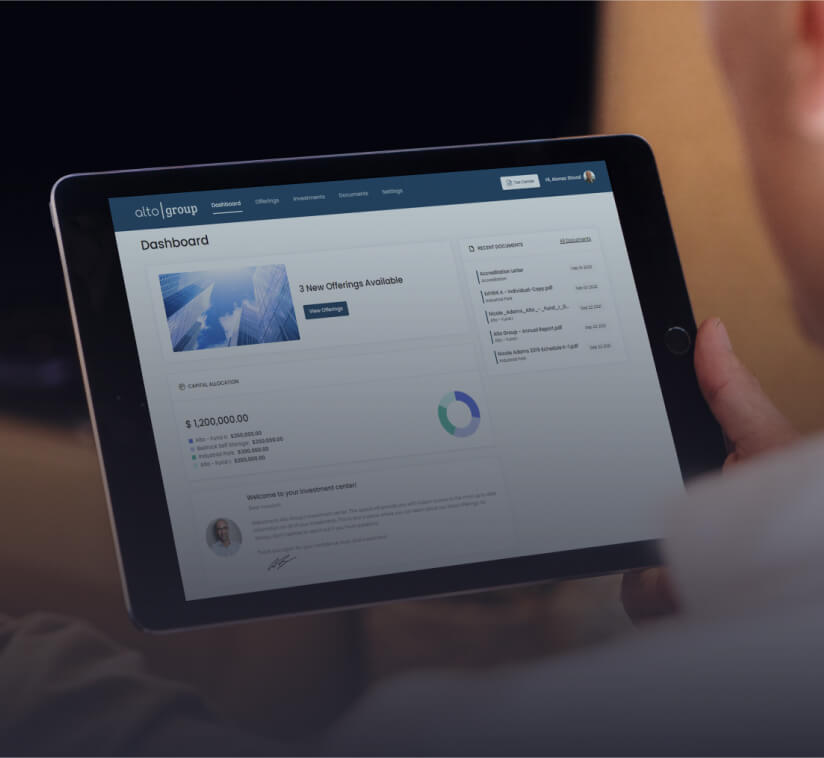

Keep commitments moving forward with single-stop accreditation directly inside InvestNext. Investors never have to leave their investor portal to obtain an accreditation letter and complete their commitment. Accreditation letters are delivered securely within 12 hours.

Investors can also upload existing letters or self-attest if they already have a relationship with your firm and completed accreditation for another commitment in the last five years.

“The introduction of InvestNext reshaped our approach. It came at a critical juncture, providing the scalability we needed to surpass our expectations of $50 million in Capital Under Management, reaching $400 million in Capital Under Management within just four years.”

Mike Williams, VP Investor Relations | Open Door Capital

Protect your firm, expand your investor network, and stay compliant with SEC regulations through fully integrated KYC/AML verification.

Build credibility and impress your investors with a meticulously designed white label investor portal. Promote offerings to new and existing investors with professional and customizable deal rooms. Accelerate capital raising with frictionless commitment flows and secure inbound funding.

Reduce administrative overhead with automated financial management.

Our analysis reveals the five strategies reshaping CRE capital raising.

Learn how top fund managers are rewriting the rules of engagement.

Drastically reduce the time it takes to raise and distribute capital.

Transform time-intensive processes into powerful and efficient investor relations tools