A great investment management solution can save your firm time, money, and help you strengthen your investor relationships. When searching for your next platform, you can’t afford partial or outdated solutions.

To help you make the best decision for your firm, this page compares InvestNext against Syndication Pro based on publicly available information and G2 Winter 2025 Reports.

Modern functionality designed for scaling firms

Direct inbound funding with ACH, co-sponsor support, complex waterfall calculations & distributions, and integrated investor accreditation and KYC/AML.

Industry leading onboarding & support

InvestNext customers go-live 2x faster and get access to quality support and exciting feature updates, regardless of size. Over 90% of support issues are fully resolved within a day by our industry-leading US-based support team.

Transparency and partnership

InvestNext is your 24/7 growth partner, dedicated to your long term success. We take client feedback seriously and put it directly into development, consistently delivering on our promises with transparency and clarity- supported by our 98% client retention rate.

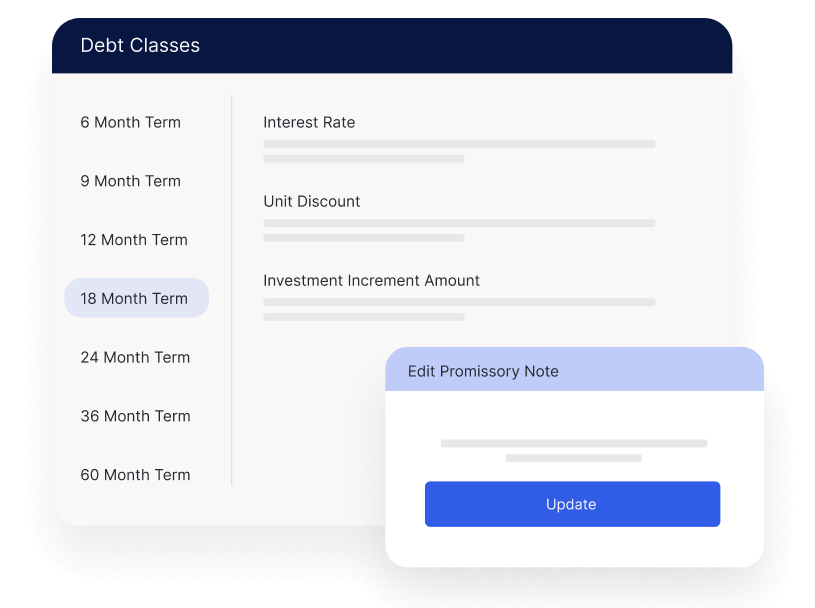

Complex Structures

More flexibility for you and your investors with support for multiple equity classes, debt, and open-ended fund structures.

Centralized Compliance

Reduce your risk, maintain compliance, and ensure a seamless investor experience through integrated investor accreditation and KYC/AML.

Enhanced Security

Protect your firm - and your investors - with bank-grade security backed by externally audited SOC 2 Type 1 and Type 2 certification.

Raise Capital Without Limits

Empower your investors with choice in how they invest their capital. Raise equity, debt, or both all within the same offering. Track commitments in your automated back office, powering promissory note payments with the same technology that calculates equity-based distributions.

Configure your offering with options like:

- Maturity date or term length

- Interest rate

- Minimum & maximum investment amounts

- Accrual and flat rates

- Auto-close for each class

- Early pay-offs and roll-offs

Raise Capital Compliantly

Raise Capital Securely

InvestNext engages in robust external audits and monthly penetration testing to continuously validate our security stack. Our platform is backed by industry leading assessments and is SOC 2 Type 2 certified by the AICPA.

Secured with AWS cloud infrastructure. We regularly backup your data with a maximum 24-hour RTO and RPO. Built-in system redundancy, 24/7 vulnerability scanning, and uptime monitoring ensures your data is always available and protected.

- Your data 100% belongs to you. We don’t mine or access your data for advertising purposes and we only use customer data to provide service; we don’t look into your account without your permission.

- OAuth2 to securely authorize other SaaS services and do not store your username or password for those services.

- Ensure the right people get the right level of access to features and capabilities, based on their roles. Turn on and off privacy impacting features to meet your needs.

Create complex distribution waterfalls with more customization options than any other tool including support for multiple equity and debt classes. Automatically calculate distributions and send secure payments to your investors with a few clicks.

Can handle simple distribution calculations.

Most distribution plans, including those with preferred returns, have to be calculated manually outside the system.

Meticulously designed deal rooms and commitment flows developed to reduce friction, drive engagement, and generate commitments.

Multiple equity classes and debt supported in the same deal room.

Support for single-asset syndication only. Does not support multiple equity classes or debt.

Flexible capital raising functionality without limits. Support for open-ended funds, fund of funds, customizable funds, and debt funds with multiple start and exit dates.

Automated financial management accounting for ownership percentages and start dates integrated in your cap table and distributions.

Does not support fund structures.

Raise capital on your timeline. Automatically calculate call amounts with precision, notify your investors, and enable them to fund with just a few clicks.

Does not support capital calls.

Give your investors anytime access to investment performance in their investor portal. Build custom reports and send statements to investors in a few clicks.

Limited reporting capabilities. Multiple steps required to produce investor statements.

Protect your firm, expand your investor network, and stay compliant with SEC regulations through fully integrated KYC/AML verification.

Does not offer integrated KYC/AML for credibility and compliance.

Verify accreditation status and empower investors to get accreditation letters – seamlessly integrated into your investor portal and commitment flow. Investors can acquire accreditation letters within 12 hours.

Investor accreditation within 48 hours.

Industry leading onboarding & support. Go-live more than 2x faster. Data migration within 7 business days of receipt. Top-tier support for all customers, regardless of size. US-based support team that addresses over 90% of requests within 1 day.

Lengthy onboarding process that can take several months. Support team not based in the US.

Transparent pricing starting at $499/Mo

Pricing not publicly available

Complex Waterfall Distributions

InvestNext

- Create complex distribution waterfalls with more customization options than any other tool including support for multiple equity and debt classes. Automatically calculate distributions and send secure payments to your investors with a few clicks.

SYNDICATION PRO*

- Can handle simple distribution calculations. Most distribution plans, including those with preferred returns, have to be calculated manually outside the system.

Raising Capital

InvestNext

- Meticulously designed deal rooms and commitment flows developed to reduce friction, drive engagement, and generate commitments. Multiple equity classes and debt supported in the same deal room.

SYNDICATION PRO*

- Built for single-asset syndications. Does not support multiple equity classes or debt.

Funds

InvestNext

- Flexible capital raising functionality without limits. Support for open-ended funds, fund of funds, customizable funds, and debt funds with multiple start and exit dates.

Automated financial management accounting for ownership percentages and start dates integrated in your cap table and distributions.

SYNDICATION PRO*

- Does not support fund structures.

Capital Calls

InvestNext

- Raise capital on your timeline. Automatically calculate call amounts with precision, notify your investors, and enable them to fund with just a few clicks.

SYNDICATION PRO*

- Does not support capital calls.

Reports & Statements

InvestNext

- Give your investors anytime access to investment performance in their investor portal. Build custom reports and send statements to investors in a few clicks.

SYNDICATION PRO*

- Limited reporting capabilities. Multiple steps required to produce investor statements.

KYC/AML

InvestNext

- Protect your firm, expand your investor network, and stay compliant with SEC regulations through fully integrated KYC/AML verification.

SYNDICATION PRO*

- Does not offer integrated KYC/AML for credibility and compliance.

Onboarding & Support

InvestNext

- Industry leading onboarding & support. Go-live more than 2x faster. Data migration within 7 business days of receipt. Top-tier support for all customers, regardless of size. US-based support team that addresses over 90% of requests within 1 day.

SYNDICATION PRO*

- Lengthy onboarding process that can take several months. Support team not based in the US.

Integrated Accreditation

InvestNext

- Verify accreditation status and empower investors to get accreditation letters – seamlessly integrated into your investor portal and commitment flow. Investors can acquire accreditation letters within 12 hours.

SYNDICATION PRO*

- Investor accreditation within 48 hours.

Price

InvestNext

- Transparent pricing starting at $499/Mo

SYNDICATION PRO*

- Pricing not publicly available

Natalia Linchenko

TAG SLC

“When we stacked it up against Juniper Square, InvestNext was an easy choice. My positive experience with InvestNext was anchored in its user-friendly interface, robust distribution capabilities, cost-effectiveness, and exceptional support."

Mike Williams

Open Door Capital

“The introduction of InvestNext reshaped our approach. It came at a critical juncture, providing the scalability we needed to surpass our expectations of $50 million in Capital Under Management, reaching $400 million in Capital Under Management within just four years."

Victor Pasaran

Pasago Investment Management

“InvestNext wasn’t just a tool for me. It was a game-changer in how I managed my portfolio, allowing me to see the bigger picture, analyze data, and diversify investments across various markets, thanks to its versatility."

Raise Capital Without Limits

With industry-leading functionality. Deliver an elevated investor experience with modern deal rooms, frictionless capital raising, direct inbound funding, co-sponsor support, fund support, and capital calls.

Industry Leading Onboarding & Support

InvestNext customers go-live 2x faster and get access to quality support, regardless of size. US-based support team that addresses over 90% of requests within 1 day.

Distribution Automation

Create complex distribution waterfalls for any operating agreement, automatically calculate distributions and send secure payments to your investors with a few clicks.