Real estate syndication is an exciting pathway that allows multiple investors to come together and participate in big-ticket commercial or residential projects. If you’re a syndicator, picking the right exemption for offerings is a critical task. It helps you stay within the boundaries of securities laws and, at the same time, attract potential investors.

In this article, we aim to clarify the distinctions between two commonly used exemptions under Regulation D of the Securities Act of 1933: 506(b) and 506(c). Understanding these differences is crucial for both syndicators and investors as they determine the rules and limitations surrounding the offering process.

What do Security Regulations Mean?

Security regulations are a set of rules and guidelines established by the Securities and Exchange Commission (SEC) to ensure the integrity of the U.S. financial markets. These regulations govern the issuance, sale, and trading of securities, which include stocks, bonds, mutual funds, and other investment products. The primary goal is to safeguard investors’ interests, promote market efficiency, and prevent fraudulent activities.

The SEC is a federal agency responsible for overseeing the securities industry and enforcing security regulations. It works to maintain fair and transparent markets, protect investors from fraudulent practices, and facilitate capital formation. The SEC achieves these objectives through a variety of activities, including market surveillance, rulemaking, enforcement actions, and investor education.

Key Security Regulations to Know:

- Securities Act of 1933 – This landmark legislation requires companies to provide full and fair disclosure of material information to investors before issuing securities. It also regulates the initial public offering (IPO) process and aims to prevent fraud in the sale of securities.

- Securities Exchange Act of 1934 – Governs the trading of securities after their initial issuance. It requires companies to register with the SEC and disclose periodic reports, including financial statements. The act also establishes rules for insider trading, proxy solicitations, and market manipulation.

- Investment Advisers Act of 1940 – Regulates individuals and firms that provide investment advice for compensation. It requires investment advisers to register with the SEC, adhere to fiduciary duties, and disclose potential conflicts of interest.

As an investor, it’s crucial to understand your rights and protections under security regulations. The SEC requires brokers, investment advisers, and other market participants to act in their clients’ best interests and provide suitable investment recommendations. It also provides mechanisms for reporting suspicious activities or filing complaints if you suspect fraud or misconduct.

What is Regulation A

Regulation A provides a registration exemption for public offerings and comes with two distinct tiers.

Tier 1 accommodates offerings up to $20 million within a 12-month timeframe, while Tier 2 covers offerings reaching up to $75 million within the same period. For offerings that do not exceed $20 million, companies have the liberty to choose between Tier 1 or Tier 2 stipulations.

When it comes to real estate, developers can raise up to $50 million for their projects. This framework lets them offer equity or debt to the public, sidestepping some of the rigorous requirements typical of a conventional initial public offering (IPO).

For real estate developers seeking capital, Regulation A+ offers a flexible and accessible alternative. It provides an opportunity to engage with a wider range of investors and tap into the public’s interest in supporting compelling real estate ventures.

Regulation D (Reg D), Rule 506

In multifamily syndication, Regulation D Offering (Reg D) and its Rules 506(b) and 506(c) are the most common means of raising private placement funds. Reg D enables small businesses and investors to raise capital for a transaction without registering each individual’s contribution as a security measure. Rule 506 ensures that the General Partner (GP) provides accurate and forthright information, thereby avoiding misleading or deceptive statements.

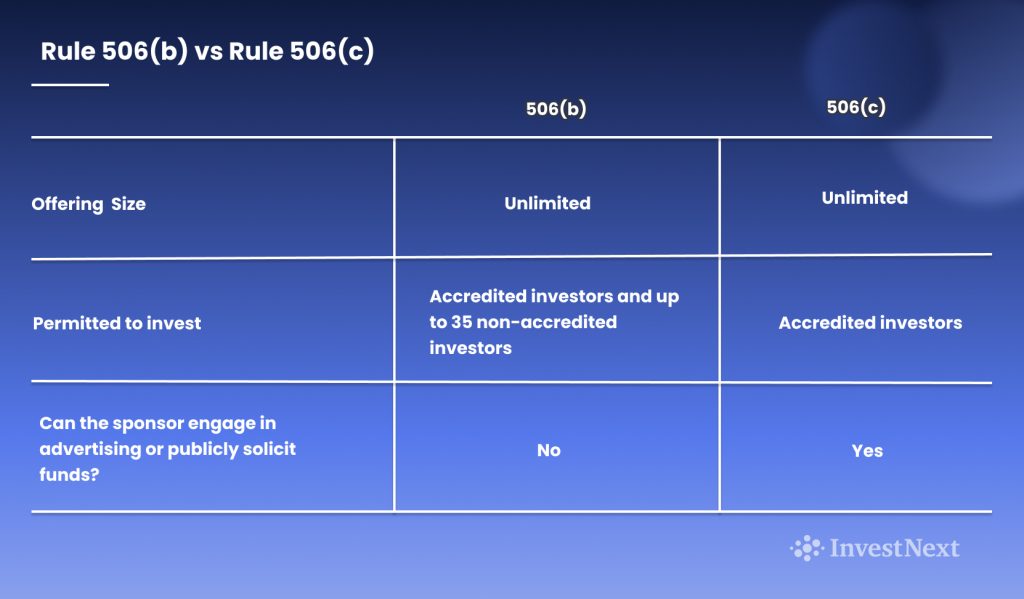

GPs are required to choose between Rule 506(b) and Rule 506(c) registration from the outset. The primary difference between these two regulations is in their respective advertising measures. Rule 506(c) allows advertising, whereas rule 506(b) prohibits it. In property transactions, the specific exemption mandated by federal securities laws is typically disclosed in the disclaimer portion of the private placement memorandum (PPM), which typically comprises the first two to three pages.

These disclaimers describe the offerings’ compliance with federal securities laws and identify applicable exemptions. As a sponsor, it is essential to select an appropriate exemption for your offerings to ensure compliance with securities laws, while effectively attracting potential investors.

Rule 506(b) vs Rule 506(c)

Rule 506(b) is a traditional choice real estate sponsors (syndicators, general partners), providing flexibility in soliciting and accepting investments from accredited investors. Under this exemption, syndicators can offer their investment opportunities to a maximum of 35 non-accredited investors, who must meet specific sophistication standards.

However, Rule 506(b) has certain limitations:

- No General Solicitation: Syndicators cannot use general solicitation or advertising to attract potential investors. They must rely on pre-existing relationships or other private channels.

- Limited Number of Non-Accredited Investors: While non-accredited investors are allowed (up to 35), they must be financially sophisticated and experienced to assess the associated risks.

- Challenges in Investor Verification: Even though accredited investors are permitted, verifying their status can be a complex process involving scrutiny of financial statements, tax returns, or certifications from licensed professionals.

- Navigating State-Level Regulations: Besides adhering to federal rules, syndicators must also navigate state-level securities regulations, often called “blue-sky laws.”

Rule 506 C Offerings

Rule 506(c), on the other hand, allows syndicators to advertise their offerings and openly solicit potential investors freely. It lifts the restriction on general solicitation found in Rule 506(b), making it easier for syndicators to reach a wider pool of investors.

However, Rule 506(c) comes with its unique set of conditions:

- Only Accredited Investors: While the rule allows for general solicitation, only accredited investors can participate in the offerings. This means that every investor must meet specific income or net worth requirements. This omission effectively rules out about 95% of potential investors for your securities offering.

- Rigorous Investor Verification: Unlike Rule 506(b), this rule requires a strict process to verify the accredited status of all investors. There are specialized firms that can carry out this verification process for you, but it does add a bit more time to the sale.

Understanding these nuances can help syndicators and investors make more informed decisions and navigate the complex world of real estate syndication deals successfully. However, it is crucial to consult with both a real estate attorney and a securities attorney to determine the best approach for your specific circumstances. These professionals will provide expert guidance and ensure compliance with relevant laws and regulations.

How to Choose Between Rule 506(b) and Rule 506(c)

When deciding between Rule 506(b) and Rule 506(c), syndicators should consider their business model and the pool of potential investors they’re aiming to attract.

Consider Your Investors’ Profile

If you’re considering non-accredited investors or those with whom you already have a relationship, Rule 506(b) might be your best bet. It allows you to include a small number of non-accredited but sophisticated investors.

However, if your target audience is primarily accredited investors and you’re confident about verifying their status, Rule 506(c) can be a strong choice. It provides the freedom to use general solicitation, potentially widening your pool of investors.

Consider the Verification Process

The verification process can be a deciding factor. With Rule 506(b), the process is less stringent. Accredited investors self-certify their status, which simplifies paperwork. However, Rule 506(c) requires formal verification. This step can be more time-consuming, but it provides added assurance that investors meet the necessary criteria.

Navigating Exemptions: A Syndicator’s Roadmap

Understanding and complying with Regulation D’s Rule 506(b) and 506(c) can be complex for syndicators. Still, it is essential to safeguard investor interests and maintain regulatory compliance. Here are some best practices to keep in mind:

- Verify Investor Accreditation: Always make sure you accurately verify investor accreditation status, especially under Rule 506(c).

- Maintain Documentation: Keep a comprehensive record of all communication with investors. Documentation can help safeguard against potential legal challenges or disputes.

- Stay Informed: Rules and regulations evolve. Stay updated about changes to ensure continuous compliance and to make the best choices for your syndication strategy.

- Get Legal Counsel: Regulatory matters can be complex. Consider getting advice from a securities attorney or compliance professional to ensure you’re on the right track.

Management Tools to Secure Investors

Effectively monitoring investor performance and raising capital can be difficult without the right software. InvestNext is an all-in-one solution-based platform that enables you to manage the entire lifecycle of your real estate syndication.

From same-day ACH transactions to waterfall calculations, impress your investors with stylish deal rooms and a clean-cut, easy-to-use investor portal.

Schedule a demo today to see how our team can help you welcome the next level of raising capital.

InvestNext’s content insights are dedicated to providing educational and informational content only and should not be construed as investment, tax, financial planning, legal, or real estate advice. InvestNext is not acting as an advisor or agent to you. Please seek advice from your own experts in these areas. While InvestNext strives to provide accurate information, we make no representations or warranties about the accuracy or completeness of the information contained in this article.

Additional Commercial Real Estate Resources

How-To Guide on How to Raise Capital For Commercial Real Estate Properties