Today’s commercial real estate market, it’s not just small-mid sized funds that are facing significant liquidity challenges due to high investor redemption requests and rising interest rates.

Starwood Capital Group’s $10 billion Starwood Real Estate Income Trust (SREIT) is a prominent example, having nearly exhausted its $1.6 billion line of credit and limited redemptions since 2022.

Meanwhile, banks are tightening lending policies for all CRE loan categories, “including the spread of loan rates over the cost of funds, maximum loan sizes, loan-to-value ratios, debt service coverage ratios, and interest-only payment periods.” – Globe Street

As a smaller/midsized fund, how can you navigate similar challenges effectively?

Essential Tools & Integrated Solutions

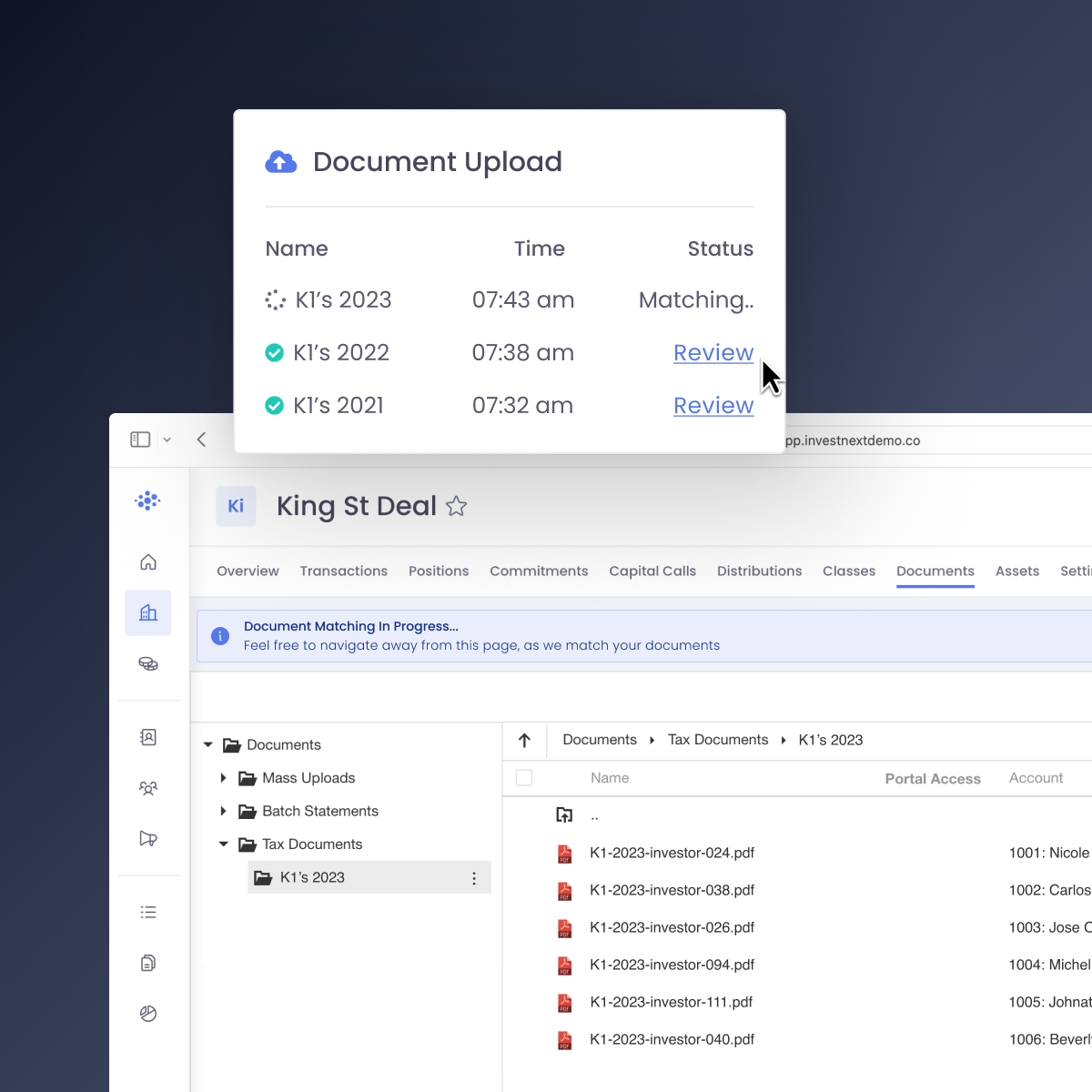

InvestNext offers a suite of tools and features that can help real estate funds manage these hurdles.

Here’s how:

1. Investor Communication and Transparency

Automated Updates: Keep your investors informed with regular updates on fund performance, asset valuations, and liquidity status, maintaining their confidence even during tough times.

Customizable Reporting: Generate detailed, customized reports to share with investors, providing clarity on fund strategies and the financial health of their investment.

2. Redemption Management

Redemption Tracking: Efficiently manage and track redemption requests.

Investor Portals: Provide investors with a secure portal to view their investment details, redemption status, and fund updates, enhancing trust and reducing uncertainty.

3. Fundraising and Investor Relations

Marketing Tools: Market new investment opportunities and manage fundraising campaigns. Present a strong case to potential investors, even in a tough market.

CRM Integration: Manage relationships with current and prospective investors through integrated CRM tools, ensuring timely and effective communication.

4. Regulatory Compliance and Reporting

Compliance Tools: Ensure compliance with regulatory requirements regarding investor communications, fund operations, and financial reporting.

Audit Trails: Maintain comprehensive records of all transactions and communications, aiding in audits and regulatory reviews.

5. Data Security and Access

Secure Platform: Protect sensitive investor information with robust security measures, ensuring data integrity and privacy.

Role-Based Access: Control access to information based on user roles, ensuring only authorized personnel can access certain data.

Real-World Application for Smaller Funds

For funds facing high redemption requests and limited liquidity, InvestNext can:

- Help you easily communicate redemption policies and current liquidity status clearly to investors.

- Track redemption requests and manage them according to new limits.

- Provide regular updates on steps being taken to manage liquidity, such as asset sales or credit line usage.

- Assist in fundraising efforts by showcasing the fund’s strategies and resilience through detailed reports and secure investor communications.

By leveraging InvestNext’s comprehensive platform, you can navigate financial challenges more effectively, maintain investor confidence, and position yourself for future stability and growth.

Ready to take control of your fund’s challenges?

Schedule a demo to learn more about how InvestNext can help you today.