Protecting capital raisers, their investors, and their deals.

While financial institutions have clear, stringent Anti-Money Laundering (AML) requirements, the real estate sector often faces a patchwork of regulations that vary significantly from one country to another and even within regions in the same country. This inconsistency leads to confusion that causes many of today’s real estate syndicators and fund managers to engage in high-risk behaviors—often due to resource limitations or to preserve their investor experience.

However, in today’s regulatory landscape, we’re seeing a tightening of AML regulations across many sectors, including real estate.

- In January 2026, the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) will require many investment advisers to establish an Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) program.

- The Financial Crimes Enforcement Network (“FinCEN”) now requires entities that own and operate U.S. real estate to report their “Beneficial Owners”—the natural persons who ultimately own or control such entities—to FinCEN.

- Financial institutions and real estate professionals are increasingly expected to conduct enhanced due diligence on clients involved in real estate transactions (particularly high-value properties or entities with complex ownership structures).

- Authorities are paying closer attention to real estate transactions involving entities or funds originating from jurisdictions known for weak AML controls or high levels of corruption.

These measures align with global trends, where real estate transactions are increasingly scrutinized to prevent illicit money flows.

While these changes may not have an immediate or universal impact on the way we handle compliance within the investment management sector, they speak to the larger intent of regulatory bodies to take a closer look at how AML is being implemented in the real estate space. It is more important than ever to truly know who your investors are, especially when facilitating investments digitally through an investment management platform.

The Announcement

At InvestNext, we strongly believe that KYC/AML verification will eventually become the new normal for real estate investing. As such, we wanted to be at the forefront of integrating this process into sponsors’ investor subscription and commitment flows.

That’s why we’re thrilled to announce that as of today, integrated KYC/AML verification is now available for all clients on InvestNext.

According to InvestNext Co-Founder and Chief Product Officer Matthew Attou,

“Fraud is on the rise and real estate is not immune to these bad actors. More than $4.6 billion was lost in 2023 to fraudulent investments; more than any other category according to the FTC. KYC verification is another major milestone on the path to setting the standard for what a safer and compliant investing experience looks like.”

Required or Recommended: The Benefits Remain

While the evolving regulations may not currently require KYC/AML for every real estate syndication or fund manager, the long-term benefits of a strong compliance strategy are substantial for anyone raising capital.

Incorporating trust and safety measures like KYC/AML or investor accreditation protects your firm from fines, penalties, and lost investor trust due to a regulatory breach and creates a heightened sense of credibility and authority when investors enter your investor portal for the first time.

Compliance isn’t just a protective shell to place around your firm. It can also be a tool that builds trust and ensures that you deliver a positive, safe experience for your investors every step of the way.

According to InvestNext Co-founder and CEO Kevin Heras,

“A key component of our strategy is empowering clients with the infrastructure needed to navigate a constantly tightening regulatory landscape. InvestNext’s KYC/AML module is a prime example of an integrated solution that aligns with this goal. We’ve had the privilege of collaborating with a diverse group of institutions and sponsors who have utilized our KYC/AML solution through early access.”

Feedback has been overwhelmingly positive, revealing two significant trends:

- Sponsors are using KYC/AML proactively: this approach adds a crucial layer of confidence, ensuring audit-readiness and verification of all capital partners and investors in a given investment, significantly minimizing the risk of exposure to bad actors.

- KYC/AML inherently fosters investor trust: investors are already familiar with KYC/AML, especially those involved in public markets or other regulated securities. The fact that investors can now seamlessly run through a KYC/AML check and have an institution-grade experience through our platform enables our clients to enhance their sophistication and build greater trust among investors throughout the investment transaction.

Understanding Risks and Benefits

An efficient KYC/AML process can provide a wide range of benefits for your business; without it, the risk can be equally impactful.

Without Integrated KYC/AML | With Integrated KYC/AML |

You risk fines, penalties, and lost investor trust due to a breach in compliance regulations | You have a streamlined, integrated process in place and a clear pathway for mitigating elevated risk |

Your deals are thrown off track due to compliance issues that could have been detected at the beginning stages of your raise – or even during investor onboarding | Your deals maintain their desired timelines – stabilizing your deal profitability and ensuring you’re investing resources effectively |

Your investor is a high-risk individual, and you risk funds being frozen and deals being delayed during an active investigation | You promote your compliance – and credibility – as a great way to differentiate your business and gain investor confidence |

Your manual KYC/AML process delays investor onboarding and potentially contributes to lost investments | You have safeguards in place that allow you to move quickly – onboarding more investors and facilitating more investments – all to create safe and scalable growth |

Without KYC, sponsors could risk fines, penalties, and lost investor trust due to a regulatory breach. Once trust is gone, it can be nearly impossible to recover. Deals can be thrown off track due to issues that could have been detected before a high-risk investor became attached to the deal. Funds can be frozen during an active investigation, impacting timelines and relationships with other investors.

However, with KYC/AML, sponsors have an integrated process in place and a clear pathway for mitigating those risks. Sponsors can help ensure deals keep their timelines – stabilizing profitability and ensuring that resources are being invested most effectively.

Sponsors can also promote compliance and credibility to differentiate their business and gain investor confidence. This is highly beneficial for word-of-mouth referrals from investor to investor and their overall repeat investor rate.

Exploring InvestNext’s Integrated KYC/AML

InvestNext’s KYC/AML accomplishes four key objectives.

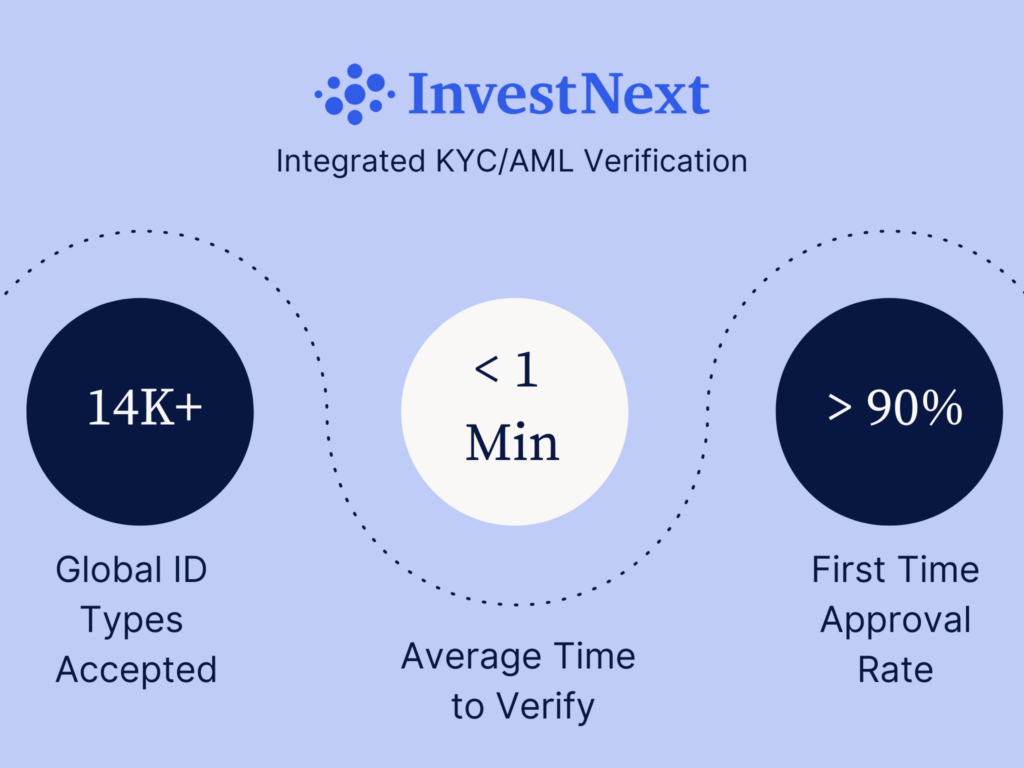

Investor Identification. First, InvestNext’s KYC/AML is designed to verify investors’ identities. The first step involves the investor uploading an ID document. Our KYC/AML accepts over 14,000 global ID types, so regardless of where your investor is from, they should be able to easily access an accepted ID form for our system.

Watchlist Database Screening. We scan public and government databases to assess an investor’s profile and background in a watchlist screening. We check 10,000 independent and reliable data sources from 200+ countries and territories to ensure compliance with all local and global standards.

Politically Exposed Person Assessment. We check for anyone who might be considered a Politically Exposed Person to ensure there isn’t a conflict of interest in the deal. This check doesn’t necessarily disqualify an investor from participating but allows the sponsor to identify an area of risk and make an informed decision about how they want to proceed with the investment.

Biometric Liveness Check. Some KYC processes involve a list of questions related to past residences, such as when, how long, and where the person resided. However, this information can sometimes be frustrating or difficult to recall on the spot. Our KYC process removes that component entirely by doing a quick camera check and cross-examining it with the investor’s ID. The entire flow is designed to be as fast and easy as possible and can be completed in less than one minute.

Speed, Accuracy, and Safety Within Reach

Though investors benefit from the speed of our solution, sponsors will also benefit from its accuracy. With InvestNext’s KYC/AML, over 90% of US-based investors are approved on their first attempt. Some European countries have first-time approval rates of 95% or above.

When we examined existing solutions on the market, three primary issues prevented them from being easily adopted by today’s real estate syndicators and fund managers. Our solution stands apart by avoiding these issues.

Highly manual. Firms were emailing investors for their IDs then manually searching for them across SEC databases. This process takes a lot of time that sponsors could be investing into more impactful parts of their business. Manual processes also greatly increase the risk of human error, allowing some high-risk investors to slip through the cracks.

Disconnected from the sponsor’s core technology. Sponsors do not want to send investors to other sites or platforms to complete these requirements. Especially if their investors are not the most tech savvy, the sponsor might lose investors (and investments) along the way.

“During the KYC check, the investor provides sensitive information. Having to switch between systems to do this reduces the feeling of trust and safety during a time when the investor should feel extra secure about how their info is being used and handled,” – Liva Lagestrand, InvestNext Senior Product Manager.

It’s too expensive. Other integrated solutions charge close to $100 per verification; for some clients, that cost can make KYC/AML inaccessible for their business. Because of its importance, we want to increase access and availability to this type of tool regardless of firm size.

Alternatively, InvestNext’s integrated KYC/AML can be dispatched in just a few clicks. Sponsors can send requests directly to their contacts via email or integrate the KYC/AML verification process directly inside the commitment flow.

Our solution also offers KYC and KYB, so investors can follow the same streamlined process whether they are investing as individuals or entities.

Sponsors are charged for KYC/AML monthly based on usage at an affordable rate.

Processes and Technology That Adapts With You

As regulations evolve, it’s impossible to pinpoint what changes remain ahead. However, it’s more important than ever for firms to align with a technology partner that is investing in flexible compliance features that empower them to easily adapt when the time comes.

InvestNext’s integrated KYC/AML is a product of our commitment to develop tools, integrations, and resources that empower our clients and investors to operate safely and compliantly—aligned with the best interests of all sponsors on our platform and their investors.

Take advantage of KYC/AML today to protect yourself and your investors, boost your credibility, and create safe and scalable growth for your firm.

You can learn more about using InvestNext’s KYC/AML here.