First Rate Reduction Since 2020 Marks Policy Shift

The Federal Reserve announced a 50 basis point rate cut on September 18, 2024, lowering the target range to 4.75% to 5%. This marks the first reduction since March 2020, indicating a significant shift in monetary policy. The decision, detailed in the FOMC statement, comes as the Fed sees progress in its fight against inflation while maintaining confidence in economic growth.

Key Insights

- The Fed’s 50 basis point cut exceeds expectations, including our previous 25 basis point reduction prediction, indicating a more aggressive stance than anticipated.

- FOMC projections suggest further rate cuts ahead, with the median federal funds rate projected at 3.4% by the end of 2025.

- The Fed expects inflation to continue declining, reaching 2.1% by 2025, while maintaining steady GDP growth around 2%.

- A slight increase in unemployment is projected, peaking at 4.4% in 2024 before gradually declining.

- Real estate markets could see significant impacts, with potential mortgage rate decreases stimulating both residential and commercial activity.

- Global markets reacted positively initially, but gains were pared back due to concerns about the larger-than-expected cut.

Fed Balances Inflation Progress with Labor Market Strength

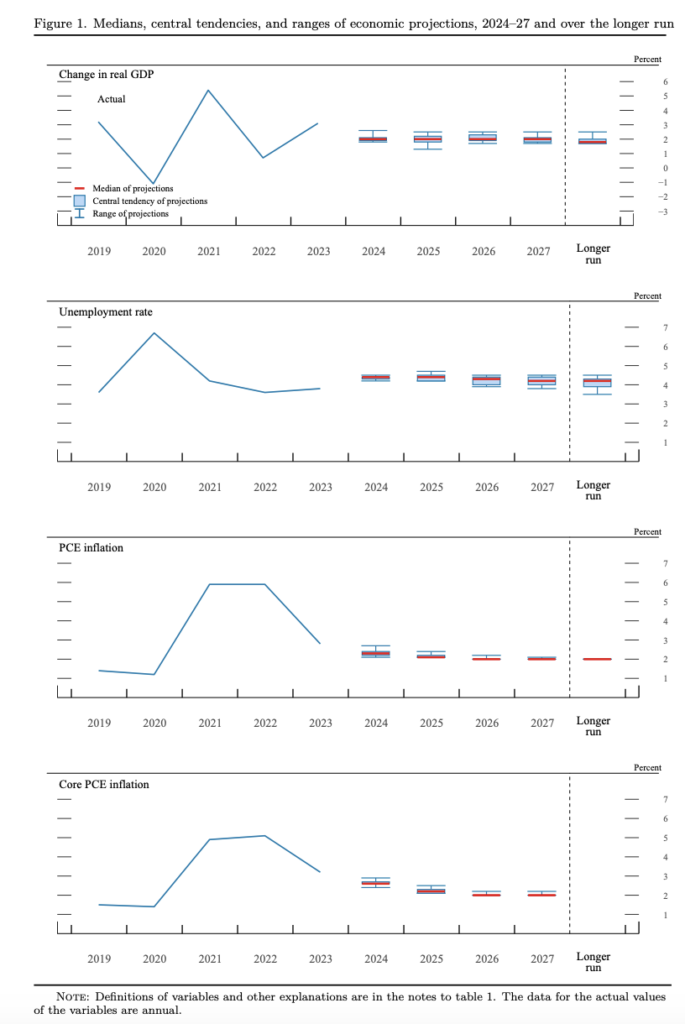

Federal Reserve Chair Jerome Powell emphasized the complex economic landscape in his post-meeting press conference. “We’re trying to achieve a situation where we restore price stability without the kind of painful increase in unemployment that has come sometimes with disinflation,” Powell stated. This balance is reflected in the Fed’s latest economic projections:

The Fed’s outlook paints a picture of gradual economic adjustment. Inflation, measured by Personal Consumption Expenditures (PCE), is expected to decline steadily, reaching 2.1% by 2025. This forecast suggests the Fed’s policy actions are effectively addressing inflationary pressures.

At the same time, the unemployment rate is projected to rise slightly, peaking at 4.4% in 2024 before gradually declining. This modest increase, coupled with the rate cut, indicates the Fed’s willingness to accept some labor market cooling to ensure long-term economic stability.

GDP growth projections remain steady around 2% through 2027, reflecting the Fed’s confidence in the economy’s resilience. This aligns with Powell’s statement: “The U.S. economy is in good shape. It is growing at a solid pace. Inflation is coming down.”

These projections provide context for the Fed’s decision, illustrating a careful balancing act between controlling inflation and maintaining economic growth.

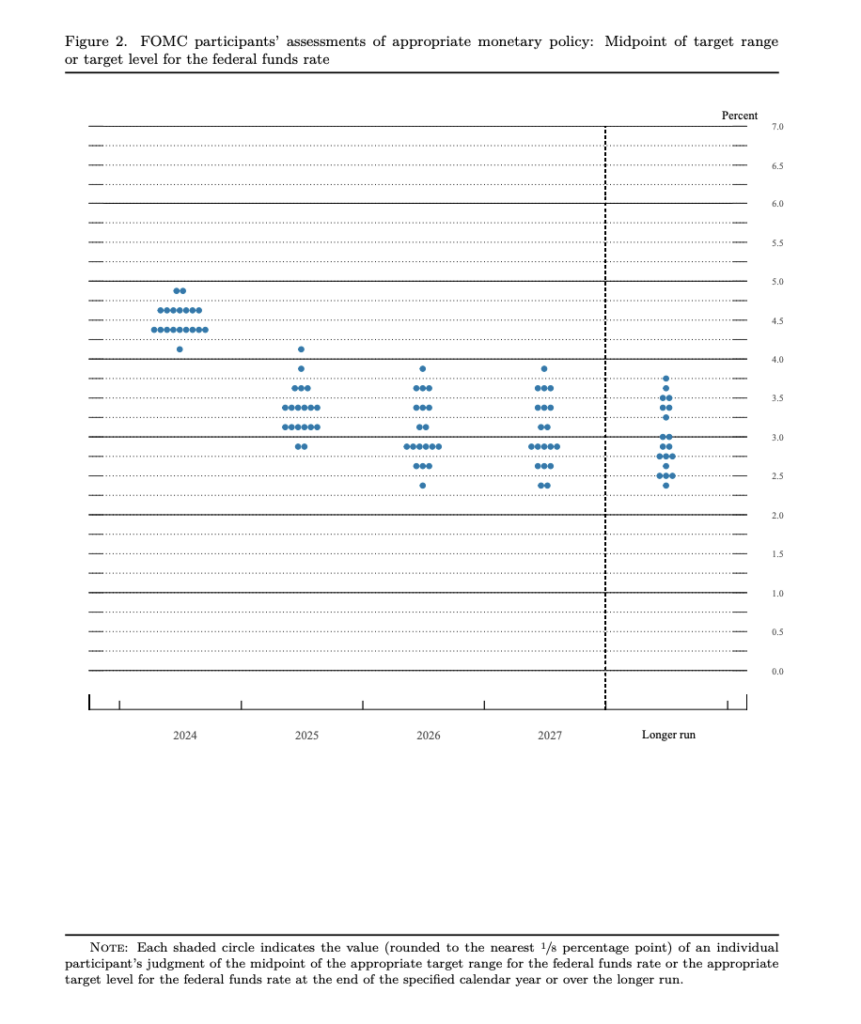

FOMC Projections Suggest Further Rate Cuts Ahead

The Federal Reserve uses a tool called the “dot plot” to visually represent FOMC members’ expectations for future rate movements. Each dot on the plot represents a member’s projection for the federal funds rate at the end of each year and in the longer run.

Looking at the dot plot, we see a clear downward trend in rate expectations. Most FOMC members anticipate further cuts in the coming years, suggesting a sustained period of monetary easing. However, the spread of the dots also shows some disagreement among members about the pace and extent of future cuts.

Powell cautioned against assuming a preset course: “We’re going to go carefully meeting by meeting, and make our decisions as we go.” This statement underscores the Fed’s data-dependent approach and suggests that while the general direction is towards easing, the specific path of rate cuts remains uncertain.

Rate Cut Timeline Reflects Evolving Economic Conditions

The Fed’s recent policy shifts reflect its responsiveness to changing economic dynamics:

- March 2022: Rate hike cycle begins in response to post-pandemic inflation

- July 2023: Final hike brings target range to 5.25% – 5.50%

- June 2024: Fed holds rates steady, signals potential cuts

- September 2024: 50 basis point cut lowers range to 4.75% – 5.00%

This rapid transition from tightening to easing underscores the unusual nature of the current economic environment.

Real Estate Sector Anticipates Lower Borrowing Costs

The rate cut could significantly impact real estate markets. According to CNBC, Mike Fratantoni of the Mortgage Bankers Association predicts mortgage rates could drop to around 6% over the next year. This decrease in borrowing costs could stimulate activity in both residential and commercial real estate.

However, Powell cautioned against expecting a return to ultra-low rates: “Intuitively, most — many, many people anyway — would say we are probably not going back to that era where there were trillions of dollars of sovereign bonds trading at negative rates, long-term bonds trading at negative rates.”

Global Markets React to Fed’s Decision

While focused on the U.S. economy, the Fed’s decision has global implications. The CNBC report noted that the S&P 500 and Dow Jones Industrial Average initially touched new records following the announcement, before paring gains due to concerns about the larger-than-expected cut.

Implications for Real Estate Investors and Fund Managers

The Fed’s 50 basis point rate cut, combined with ongoing market trends, reshapes the landscape for real estate investment. This shift coincides with the approaching real estate debt maturation wave, creating both challenges and opportunities across sectors.

According to Moody’s, Industrial properties are likely to maintain their strength, while the office sector, with a 20.1% national vacancy rate, continues to face headwinds. The multifamily and retail sectors show signs of stabilization, with regional variations influencing performance.

For fund managers, this environment necessitates:

- Sector-specific strategies to capitalize on diverging market trends

- Robust underwriting to assess refinancing risks and opportunities

- Agile capital deployment to leverage potential distressed asset sales

- Enhanced investor communications to articulate strategies in this evolving market

As large loan transactions lead the market recovery, opportunities for substantial, strategic investments may increase. Fund managers who can effectively navigate this changing landscape, leveraging data-driven insights and advanced investment management tools, will be best positioned to capitalize on emerging opportunities in the coming months.