In a pivotal announcement at the Federal Reserve’s annual conference in Jackson Hole, Wyoming, Fed Chair Jerome Powell signaled a significant shift in monetary policy. “The time has come for policy to adjust,” Powell stated, marking a transition that could have far-reaching implications for the real estate investment landscape.

The Fed’s New Playbook

Powell’s statement marks a clear departure from the Fed’s previous focus on combating inflation to a new emphasis on preserving job market strength. This shift comes as the Fed sees progress in its fight against inflation, with the rate nearing its 2% target and noting concerns about the labor market.

Key Takeaways:

- Imminent rate cuts are on the horizon, driven by a softening labor market. For GPs and Fund managers, this could mean more favorable financing conditions in the near future.

- With unemployment at 4.3%, the Fed shows increased concern about job market health. This focus on employment could lead to more aggressive rate cuts if job losses accelerate.

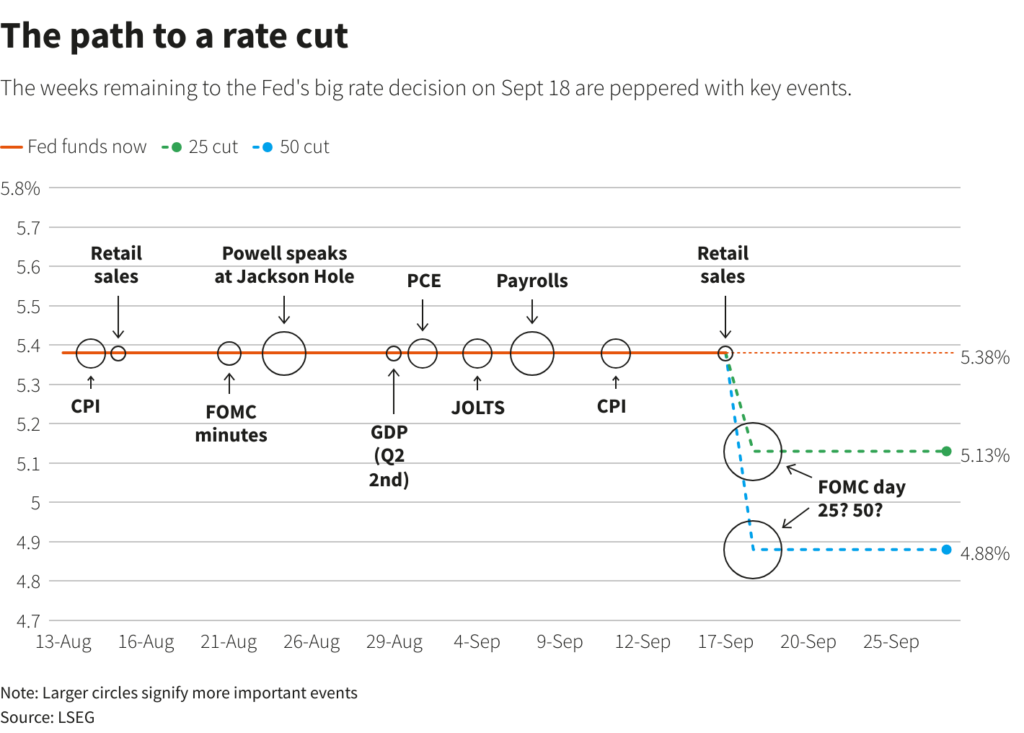

- A potential rate cut in September is now widely expected, with debates centering on whether it will be 25 or 50 basis points. The size of this cut could set the tone for real estate market activity in Q4 2024 and beyond.

Market Dynamics

The Fed’s shift comes amid changing economic conditions. “We do not seek or welcome further cooling in labor market conditions,” Powell emphasized, highlighting the delicate balance the Fed is trying to strike between controlling inflation and maintaining a robust job market.

The Details:

- Labor market cooling is “unmistakable,” but it is still primarily driven by slower hiring rather than layoffs. This gradual cooling could provide a smoother transition for real estate markets compared to a sharp downturn.

- Housing market impact: Mike Fratantoni of the Mortgage Bankers Association predicts mortgage rates could drop to around 6% over the next year. Such a decrease could reinvigorate both residential and commercial real estate activity.

- Investor sentiment is shifting, with markets pricing in higher chances of a 50 basis point cut. This optimism could lead to increased investment activity in real estate, particularly in sectors sensitive to interest rate changes.

What’s Next?

Powell clarified the Fed’s future direction: “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.” This data-driven approach suggests that GPs should closely monitor economic indicators to anticipate Fed moves.

The Road Ahead:

- The September Fed meeting now carries heightened importance, with a rate cut more likely than previously anticipated. The size of this cut could set the tone for real estate market activity for the remainder of the year.

- Debate between a 25 or 50 basis point cut continues. The chosen size could signal the Fed’s level of concern about the economy and influence investor behavior accordingly.

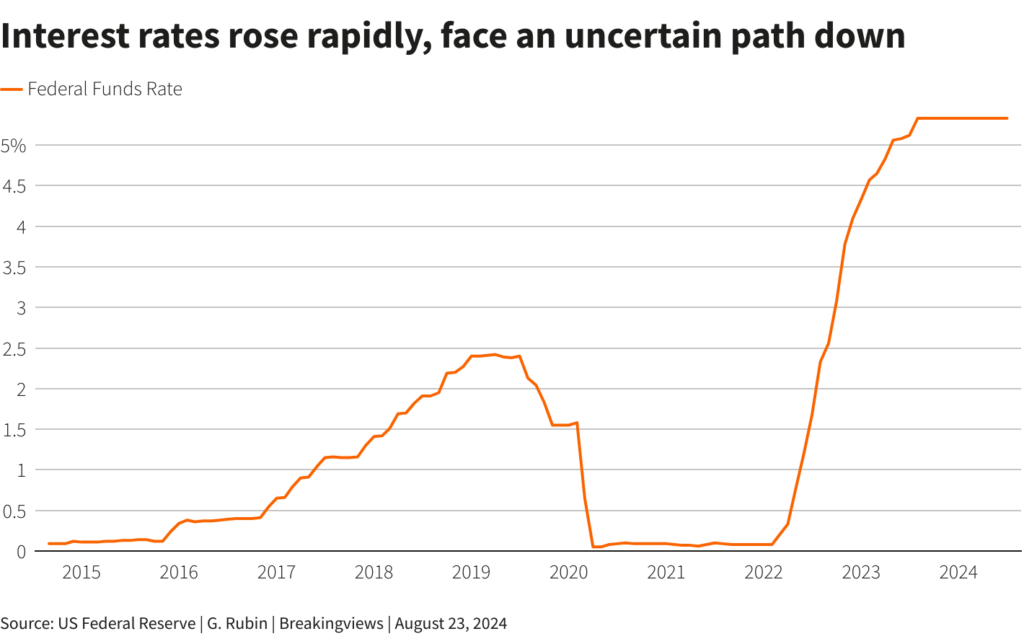

- Long-term outlook: Powell cautioned that “borrowing costs may not return to past ultra-low levels.” This suggests a new normal for financing costs that Fund Managers must factor into long-term strategies.

What This Decision Means for Sponsors and Fund Managers

Powell’s statement, “With an appropriate dialing back of policy restraint, there is good reason to think that the economy will get back to 2 percent inflation while maintaining a strong labor market,” offers a positive outlook. However, it also necessitates strategic planning for GPs.

Strategic Considerations:

- Revisit investment models and sensitivity analyses: With rate cuts on the horizon, now is the time to reassess how different rate scenarios might affect project viability and returns.

- Anticipate increased competition: Lower rates typically stimulate investment activity. Be prepared for potentially heightened competition, especially in prime markets and assets.

- Maintain agility: The Fed’s data-dependent approach means market conditions could shift rapidly. Flexible strategies that can adapt to changing rates and economic conditions will be crucial.

Interest rate decisions have a dynamic impact on commercial real estate. Lower rates can stimulate investment and potentially increase property values but may also lead to increased competition for prime assets. GPs should carefully consider how these changes might affect their specific portfolio strategies.

Bottom Line

Powell’s emphasis on flexibility—”The Fed’s framework will need to be flexible enough to handle a range of economic scenarios”—underscores the importance of Fund Managers remaining adaptable in their strategies.

GPs should carefully consider how these changes might impact their portfolios as the market adjusts to the likelihood of rate cuts. The ripple effects of the Fed’s new stance could be significant, from potential increases in property valuations to shifts in financing costs.

For context on recent Fed decisions leading up to this announcement, see our previous update on the Fed holding rates steady.

Follow this link to the official FOMC transcript to read the full announcement insights from the Fed meeting.