THE PROBLEM:

Investor Visibility – Positions & Investments

I remember receiving a call from one of our investors asking for information on their investment. They simply wanted to see how much money they had invested with our firm. They wanted to know basic information: which projects they invested in, what their returns looked like, how much was in their capital account, etc. It seemed like we should have had simple answers; however, we didn’t. We had everything on Google Sheets, and I mean everything. All of our projects had their own tabs, each containing a large amount of data specific to each investing entity. The sheets themselves contained the contact name, addresses on file, capital contributions, distributions, etc.In short: we quickly realized that there wasn’t an effective way to extract the data without navigating through each tab. Now imagine an investor using a few different entities to invest in (Individual, LLC, Trust, IRA, etc.) and being invested in every deal that we managed.For this particular investor, we eventually got them their data – but the response took an entire day.

THE PROCESS:

Data Presentation

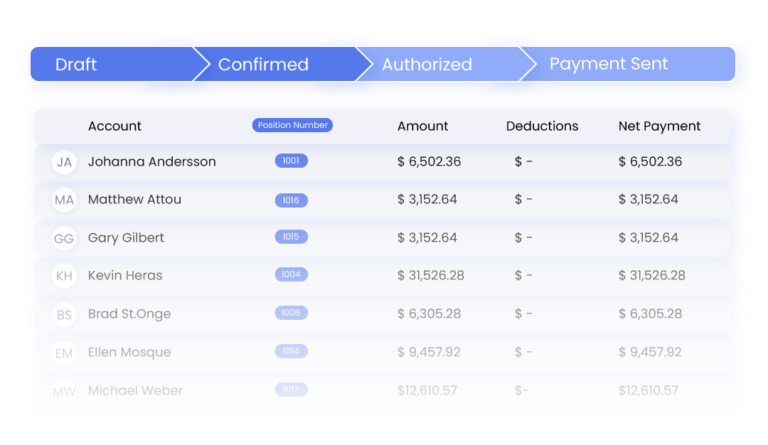

Now that I have all the data, how do I present this to the investor? What metrics does this particular investor want to see? Collecting this data from our makeshift sheet-based CRM was only the first hurdle.I started by creating a Word document – one for each investor who went through this process. The next step was to enter the information into the document manually. This process was very manual, requiring me to triple-check everything to make sure that I didn’t miss an investment or a distribution, not to mention spelling the investor names correctly. I would show this data by project and, within each project, drill down to all the entities the investor used to invest. Luckily, we didn’t have a lot of requests for these statements, but it led me to think that there has to be a better way to present this material and improve our transparency to our investors. I then posed a very important question. How do we increase investor transparency within our firm? A simple request from an investor-led me down the road to vetting several different investment management platforms. I met with countless reps, and finished free trial after free trial, in the end, I was ready to give up.

The Solution:

Simple. Refined. InvestNext.

At this point, I wasn’t sure if I would find a platform to fit my needs. Our big struggle was migrating the data. What we needed was a team who understood our problem. At a minimum, we were hoping to find a group that could help us get from our spreadsheets to a fully functioning system. After weeks of testing, I eventually connected with the co-founders at InvestNext. The team helped us transfer all of our customer data into the brand-new investor platform. When we went live with our new investor portal, our relationship with investors completely changed. Not only did the platform decrease the number of calls from investors about their investments, it also helped our team expand. InvestNext’s All-in-one platform placed all of our investors’ data in the palm of their hands. Upon first impression, our investors were shocked to find all of their data available on their phones. They were able to log in and easily view all of their investments, distributions, and investment performance. The platform also created a space for sharing K1s and other important documents. Investors could finally access all of their information and even commit funds to new offerings in one central location. Adding proper investor visibility to our processes gave our team a much more professional look. The addition of InvestNext gave us increased credibility, increasing investor confidence and boosting referrals to our firm..When asked why they would recommend our firm, investors mentioned that the increase in transparency was a major factor.