Understanding the intricacies of waterfall structures in real estate investments is crucial for investors and sponsors alike. These structures dictate how profits from a project are distributed, aligning incentives and ensuring fair outcomes. However, the complexity of these models can be daunting. This article demystifies common real estate waterfall structures, providing clarity on how cash flows through the investment tiers.

What is a Waterfall Structure in Real Estate?

A waterfall structure in real estate investment is a method of splitting profits among partners that allows for profits to follow an uneven distribution. It can be visualized as a series of pools that fill up with cash flow from an asset, spilling over into the next once full. Each pool represents a different agreement on profit distribution, ensuring a pre-arranged hierarchical division of cash proceeds.

Key Concepts in Waterfall Structures

Return of Capital (ROC)

The ROC ensures investors receive their initial capital investment back before any profit distribution occurs, emphasizing capital preservation. Return of capital doesn’t necessarily reflect investment performance or profitability. Instead, it represents a partial or full recovery of the initial investment amount

Preferred Return (“the Pref”)

The preferred return acts as a minimum threshold return for limited partners before general partners can participate in profit distributions. It’s typically expressed as an annual percentage return on invested capital.

Internal Rate of Return (IRR)

The IRR is a financial metric used to evaluate the profitability of an investment, representing the annualized rate of return. In waterfall structures, reaching target IRRs can adjust profit distribution among participants.

Hurdle Rate and Promote Structure

The hurdle rate is based on achieving a predefined IRR or equity multiple, triggering disproportionate profit distribution to incentivize deal sponsors. The promote structure specifies how profits are shared beyond the hurdle rates.

Examples of Waterfall Structures in Real Estate

Waterfall models in real estate delineate how cash flows from a project are distributed among its investors and sponsors. Here are a few detailed examples to illustrate common and complex waterfall structures:

Simple Two-Tier Structure

- First Tier: Investors receive a preferred return, typically around 5%-8%, before the sponsor participates in profits. This ensures investors earn a minimum yield on their investment.

- Second Tier: After satisfying the preferred return, any additional profits are split between the investors and the sponsor, often split at a 80%/20% or 70%/30% ratio favoring the investors. As profitability increases, this ratio might adjust to provide a larger share to the sponsor, incentivizing them to maximize the project’s returns.

Three-Tier Promote Structure

- First Tier (0-12% IRR): Investors receive 100% of the profits until a 12% IRR is achieved, ensuring the return of capital plus a basic yield.

- Second Tier (12-18% IRR): Profits are split 80% to investors and 20% to the sponsor, providing the sponsor with a share of the profits as incentives begin to align with performance.

- Third Tier (Above 18% IRR): Profits are distributed 50/50 between investors and the sponsor, significantly rewarding the sponsor for exceptional performance.

The Hurdle Rate Model

A more nuanced model involves setting specific IRR hurdles that, once achieved, alter the profit distribution to favor the sponsor. For example:

- Initial Capital Return: 100% of cash flows go to investors until the initial investment is repaid.

- Preferred Return Hurdle: Investors receive an 8% preferred return annually. Cash flows are split 80/20 between investors and the sponsor until this hurdle is met.

- Performance Hurdles: After meeting the preferred return, additional hurdles at 15% and 20% IRR adjust the split to 70/30 and 60/40, respectively, further incentivizing the sponsor.

The Catch-Up Provision Model

This complex model incorporates a catch-up provision that adjusts the distribution once the preferred return is met, allowing the sponsor to “catch up” to a predetermined equity share. For instance:

- After investors receive their preferred return, 100% of additional profits are directed to the sponsor until they achieve a specified percentage of overall profits, aligning with the agreed-upon promote structure.

- Subsequent profits beyond the catch-up phase are then split according to a new predetermined ratio, such as 50/50, reflecting the risk and reward balance between the investors and the sponsor.

These examples illustrate the flexibility and complexity of waterfall models in real estate, highlighting how they can be tailored to balance the interests of investors and sponsors while incentivizing performance and aligning goals.

What is a Common Waterfall for a Capital Event? (Sale / Refinance)

The waterfall payment structure for real estate syndications outlines the sequence of profit distribution among investors and sponsors. It often begins with preferred returns and return of capital, and then moves through various hurdles that dictate the split of remaining profits. The specifics of this structure are typically detailed in the operating agreement of the investment.

Additional Terms in Waterfall Agreements

Catch-Up Provision

Ensures the sponsor receives all cash flows after the hurdle rate is met until their share of profits equals the promote.

Hurdle Rate High-Water Mark

Prevents the sponsor from being demoted in profit share once a certain IRR threshold is reached, regardless of future performance dips.

Lookback Provision

Allows investors to recoup a pre-agreed rate of return if the project underperforms, potentially requiring the sponsor to return some of their received profits.

Cumulative and Compounding Prefs

Addresses scenarios where the preferred return isn’t met annually, detailing how unmet prefs are handled in subsequent periods.

Common Mistakes and Considerations

Creating realistic hurdle rates is essential to maintain motivation across all parties. Transparency and equal treatment of investors are also crucial to avoid misaligned expectations and ensure investor satisfaction. Most importantly, keep it simple. At InvestNext, we often see newer sponsors will have multiple investment classes in order to draw in larger investment amounts, incentivizing investors with higher preferred return rates or investor friendly splits. This can result in overly complex waterfall structures that are difficult to understand for the sponsor and the investor.

Create your first waterfall with the confidence of it being your 10th waterfall. Don’t give away preferred returns or pro rata splits with higher than average returns. Your investors will expect these higher returns and preferred return rates on subsequent investments. You have put in the due diligence to acquire and manage the asset. Make sure you earn your fair share.

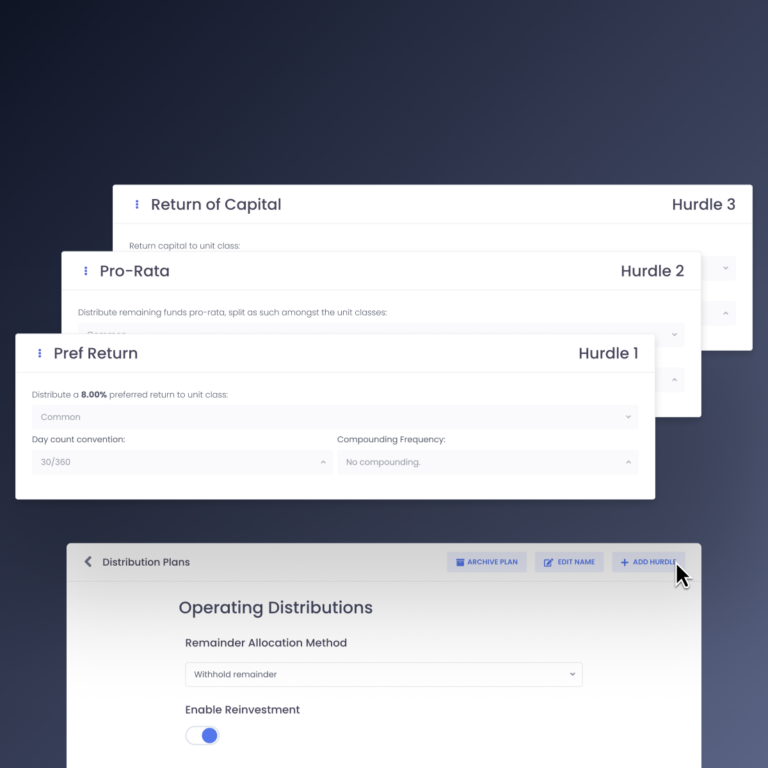

If you develop a complex distribution plan, InvestNext has you covered. We have seen a lot of complex waterfalls and have built our distribution hurdles around the needs of our clients, making the distribution process user friendly, accurate, and efficient regardless of the complexity of your distribution plan.

Final Thoughts

Real estate waterfall structures are a fundamental aspect of syndication deals, offering a framework for equitable profit distribution. By understanding these structures, and developing distribution waterfall plans that appropriately incentivize both sponsors and investors, General Partners can create structures that benefit both parties resulting in profitable deals, successful projects and investor satisfaction. If your firm is managing an active portfolio, or has an upcoming capital raise, schedule a demo to see how InvestNext’s industry leading distribution tools can enable your firm to automate distributions for any operating agreement.