Commercial real estate due diligence directly impacts investment outcomes. Data shows that many investors find costly surprises after closing that proper research would have revealed earlier.

The facts are straightforward: commercial lenders need properties to generate at least 20-25% excess income above debt service. Financial reports only tell part of the story. The standard 30-60 day investigation period requires examining everything from local zoning codes to detailed environmental reports.

Commercial deals lack many of the buyer protections found in residential transactions. Seller disclosures won’t catch everything. With transaction activity down 28% from 2023, finding issues before closing has never been more important.

A complete due diligence process identifies potential problems before they affect your bottom line. This guide breaks down the key steps successful real estate investors take before signing on the dotted line.

The Pre-Offer Phase: Essential Preparations

Smart investors know their success in commercial real estate begins way before they make an offer. The right preparation during the pre-offer phase will give a substantial boost to returns while cutting down risks. Let’s get into what makes this early stage work.

Market research fundamentals

Good market research creates the base for any soaring win in commercial real estate investment. You should first identify the Metropolitan Statistical Area (MSA) – a geographic region where population density is high and economic ties run deep. This classification helps you pull standardized data from trusted sources like the Census Bureau.

Most commercial real estate metro market reports assess these vital factors:

- Economic and demographic conditions

- Net absorption rates

- Vacancy rates

- Rental rates

- Property deliveries

- Total sales volume

- Capitalization rates

The reports also look at market-specific metrics like population growth patterns, job creation stats, major employers, education levels, and household income data. Growing markets often show positive net migration where more people move in than out. Texas and Florida topped the charts for incoming residents in 2019, while New York and California saw the most people leaving.

Property type considerations

Commercial real estate covers several distinct property categories. Each one needs its own analysis approach. These are the four major property types:

- Multifamily/Apartments: Residential buildings housing multiple units, ranging from garden-style complexes to high-rise buildings

- Office: Properties designed primarily for business operations (Class A, B, or C)

- Retail: Buildings occupied by businesses selling products/services to customers

- Industrial: Facilities used for manufacturing, warehousing, and distribution

Self-storage, healthcare properties, hotels, and senior living centers make up other commercial categories. Each type comes with unique traits that affect valuation, tenant stability, and market cycles. Understanding these differences helps you arrange investments with your risk tolerance and return goals.

Original financial feasibility analysis

You should run a quick financial check before making any offer. This helps you decide if the property deserves a deeper look. Your analysis should tell you if there’s market demand and if the numbers make sense.

Check the expected Return on Investment (ROI) to make sure the potential rewards match the risks. For properties that generate income, verify these key elements:

- Gross Potential Income (GPI): The maximum theoretical revenue if fully occupied

- Effective Gross Income (EGI): Actual expected revenue after accounting for vacancies

- Operating Expenses (OPEX): Day-to-day costs excluding capital expenditures

- Net Operating Income (NOI): Annual cash flow after expenses but before financing

Cap rates specific to your target market need attention too. Lenders use this metric to assess investment risk as it shows the expected return rate based on the property’s income.

Your due diligence team assembly

Building the right team early helps you get the full picture. Your commercial real estate due diligence team should have:

- Commercial real estate attorney

- Property inspector with commercial experience

- Environmental consultant

- Financial analyst

- Commercial real estate agent

You might need HVAC specialists, plumbing inspectors, fire sprinkler technicians, and alarm system experts for specialized areas. Make sure team members know your target property type well since each commercial category brings its own challenges.

This shared approach helps you spot potential issues before putting in serious money and avoid surprises after buying.

Physical Property Evaluation

Physical assessment is the lifeblood of commercial real estate due diligence. This vital phase shows what shape a property is in, uncovers problems that could change its value, and spots maintenance needs that affect your bottom line.

Property inspection protocols

Commercial property inspections follow the International Standards of Practice for Inspecting Commercial Properties (ComSOP). These standards, which came out in 2008 and got an update in 2022, keep commercial assessments consistent. Professional inspectors use ASTM E2018 guidelines to conduct objective property assessments.

Your consultant will do a complete walk-through survey to look at structural parts, systems, and equipment. Commercial assessments need special expertise and often bring in several professionals, unlike home inspections. The inspector will look at ten key areas:

- Building site elements

- Structural frame and building envelope

- Roofing systems

- Plumbing networks

- Heating infrastructure

- Air conditioning and ventilation

- Electrical systems

- Vertical transportation (elevators/escalators)

- Life safety/fire protection equipment

- Interior elements

Building systems assessment

Inspectors take a close look at each building system. The shape these systems are in directly changes property value and future spending

.

They check structural integrity from ground up, looking for cracks, leaks, or other problems. The inspection covers mechanical systems, electrical parts, plumbing networks, and HVAC operation. Life safety systems get extra attention – inspectors make sure alarms, sprinklers, and fire extinguishers meet current codes.

Complex systems might need special experts. To name just one example, roof specialists might check membrane condition and how long it will last, while HVAC experts could test system efficiency and code compliance.

Environmental site assessment levels

Environmental due diligence plays a vital part in property assessment. The process usually happens in phases:

Phase I Environmental Site Assessment (ESA) starts with a hands-off investigation. It looks at how the property was used, includes visual checks, and studies nearby properties for contamination risks. The goal is to spot Recognized Environmental Conditions (RECs) without disturbing the site.

If Phase I raises red flags, Phase II ESA kicks in. This deeper look involves testing soil, groundwater, and sometimes air quality. Phase II proves whether contamination exists and how bad it is, which helps decide what cleanup needs to happen.

Environmental rules vary at federal, state, and local levels, so working with good environmental engineering firms makes sense. Something that looks fine during a walkthrough could lead to legal trouble if environmental issues stay hidden.

Property condition report analysis

The Property Condition Report (PCR) wraps up physical due diligence with a detailed look at everything found during inspection. This key report helps assess risk, promotes transparency, and determines value.

The PCR’s heart lies in its Immediate Repairs Table and Replacement Reserve Table. One table shows urgent fixes needed now, while the other maps out future spending based on how long building parts will last.

Look closely at repair costs, replacement estimates, and timelines when you read your PCR. These numbers will shape your negotiating position and future spending plans. On top of that, check any suggested follow-up testing, especially in areas that raised concerns.

Physical property assessment gives you great protection against surprise costs. Good inspection, thorough building checks, proper environmental screening, and detailed condition reports build strong foundations for commercial real estate investment decisions.

Financial Due Diligence Deep Dive

A commercial property’s financial analysis demands close attention to detail. A full financial due diligence helps you spot hidden risks and confirm your investment target’s income potential.

Rent roll verification techniques

Accurate rent roll verification is the life-blood of financial due diligence. A rent roll shows all tenants in a rental property and has key data points like square footage leased, unit numbers, lease dates, monthly rent, security deposits, and expense reimbursements. Here’s how to verify this information:

Start by checking rent roll data against several months of bank statements to confirm steady income. Next, ask tenants directly for estoppel certificates to confirm lease terms. Last, match the rent roll with past operating statements to resolve any gaps—a rent roll showing $180,000 yearly income but operating statements showing only $140,000 needs deeper investigation.

Pro-forma analysis and adjustments

A pro-forma is a vital document that projects a property’s cash flow over time. This financial model works as a simplified version of the property’s combined Income Statement and Cash Flow Statement.

The key to evaluating a pro-forma lies in the fine print assumptions about income/expense growth, occupancy levels, lease renewal rates, and capital expenditures. Your analysis should start with Potential Revenue (at 100% occupancy with market rates), then adjust for empty units, below-market rents, and expected tenant changes. Pro-forma numbers become less reliable as they project further into the future, so confirming assumptions is significant.

Cap rate evaluation for your market

The capitalization rate shows a property’s expected return rate based on net operating income. The math is simple: Cap Rate = Net Operating Income / Current Market Value.

Cap rates equal the required return rate minus income growth rate. Most analysts call 5-10% a “good” cap rate, while 4% suggests lower risk but takes longer to recover investment. Prime locations often associate with lower cap rates, while higher rates usually point to more risk.

Sales comparison approach methodology

This method sets property value by looking at recent sales of similar commercial properties nearby. Here’s the process:

- Find comparable properties sold within 6-12 months

- Document specific features of each comparable

- Calculate dollar adjustments for property differences

- Analyze adjusted values to reach a final estimate

The calculation works like this: Sale Price of Comparable ± Adjustments = Estimated Value.

Average rate of return calculations

Commercial real estate ROI calculations use different methods. The cost method divides total gain (selling price plus rental income) by total cost. The out-of-pocket method looks at the investor’s equity to resale price ratio.

ROI for rental properties comes from dividing Net Operating Income by Total Out-of-Pocket Expenses. Commercial investors typically look for a cash-on-cash return of at least 12%, though individual risk comfort levels vary.

Legal and Regulatory Review

Legal agreements are the foundations of any commercial real estate deal. A full legal review will protect your investment from unexpected liabilities and keep your property rights secure.

Title search and insurance requirements

Title searches reveal significant information about who owned the property before you. They uncover potential defects that could affect your ownership rights. These defects include judgments, liens, unpaid taxes, outstanding interests, fraud, or forgery in prior conveyances. A complete title search looks at historical public records, often called “the land records” to find issues affecting the property.

Title insurance protects you against future losses from title defects and creates a contract between you and the insurance company. Unlike most insurance policies that cover future issues, title insurance protects you from “hidden risks” that happened before you bought the property. This makes it a vital part of commercial real estate due diligence.

Zoning and land use verification

Local municipalities create zoning codes to control property development within their borders. These regulations typically control:

- Setbacks (distance between property lines and buildings)

- Building size and height restrictions

- Permitted property uses

- Density limitations

Your first step should be checking with your county or municipality to learn the property’s zoning classification. Don’t assume compliance with zoning codes even if the current property use matches your plans – always verify it yourself.

Lease agreement analysis

You need to get into termination clauses, additional charges, renewal options, and security deposit conditions in commercial lease agreements. Review all legal documents tied to the property, including contracts for third-party property management or maintenance.

The financial impact of existing leases needs analysis too. Pay special attention to rent payment history to ensure steady and predictable income.

Permit and compliance confirmation

Permit checks confirm proper authorization of all construction and improvements. This process helps identify potential regulatory issues when combined with compliance checks.

Building codes, accessibility requirements, and environmental regulations apply to most commercial properties. Look for documentation errors that might create liability risks or lead to expensive penalties.

Market and Location Analysis

Location analysis makes or breaks commercial real estate investment success. A complete market and location study shows what you need to know about property value, growth potential, and investment sustainability.

Rent comparable analysis methods

Good rent comparable analysis looks at properties with matching transaction dates, locations, and physical features. Sales comps tell you about market cap rates, price per square foot, and what similar properties sold for recently. Leasing comps show current lease rates, occupancy, and absorption trends for similar properties. Timing matters most because market conditions change faster, often taking sharp turns in one direction. The most accurate comparisons come from properties in the same submarket or close to your target property.

Demographic trend evaluation

Demographics shape how commercial real estate performs and what tenants want. The U.S. population growth has slowed down, creating new challenges for the industry. A clear link exists between demographic trends and commercial real estate performance in each decade. Baby boomers are turning 65 at a rate of 10,000 people each day through 2030. The rental market has changed a lot, with 65+ households growing 43% from 2009 to 2019. Homeownership jumped from 64.6% in 2019 to 68.6% in 2022.

Economic growth indicators

Economic indicators help predict commercial property demand effectively. You should watch how inflation affects cash flows and profit margins, how interest rates change financing costs, and how manufacturing activity drives industrial real estate. Retail sales trends show consumer demand clearly. Job data and industry trends point to future office space needs.

Future development impact assessment

New developments change existing property values significantly. Your study should look at planned projects, infrastructure updates, and community growth plans. Economic studies show benefits like new jobs, income growth, and GDP contribution. Knowledge about future development helps you spot market saturation and competitive edges early.

Conclusion

Effective commercial real estate due diligence requires examining physical condition, financial performance, legal status, and market position. This process helps identify risks and confirm potential returns.

Smart investments start with thorough preparation. Physical inspections show the actual condition of assets. Financial verification confirms income potential by checking rent rolls and analyzing pro-forma statements. Legal reviews identify hidden liabilities.

Market analysis plays a crucial role in due diligence. By studying demographic trends, economic indicators, and future development plans, you make more informed investment decisions.

With fundraising cycles now stretching to 24 months, thorough due diligence gives investors confidence to commit capital. Documentation, organization, and attention to detail make the difference.

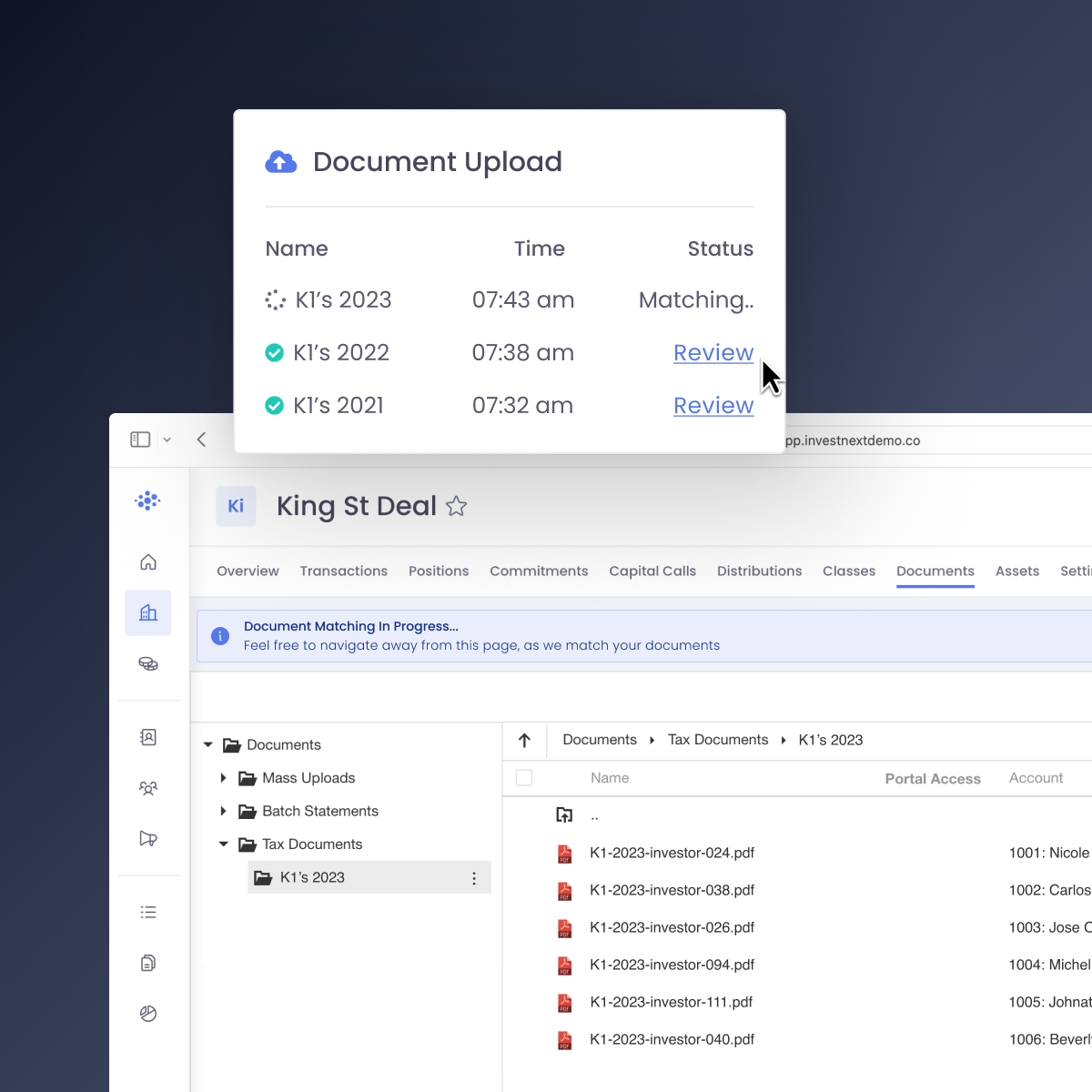

Want to see how investment management technology can improve your due diligence process? Book a demo to discover how InvestNext helps real estate firms create more reliable workflows that support growth in today’s market.

FAQs

What are the key components of commercial real estate due diligence?

Commercial real estate due diligence involves several crucial components, including physical property evaluation, financial analysis, legal and regulatory review, and market and location analysis. Each of these aspects helps investors uncover potential risks and validate investment opportunities.

How long does the typical commercial real estate due diligence period last?

The typical commercial real estate due diligence period usually lasts between 30 to 60 days. This timeframe allows investors to thoroughly investigate all aspects of the property before finalizing the transaction.

What is a cap rate and why is it important in commercial real estate investing?

A cap rate, or capitalization rate, is a metric used to estimate the potential return on a real estate investment. It’s calculated by dividing the property’s net operating income by its current market value. Cap rates are important because they help investors compare different properties and assess the risk-return profile of an investment.

Why is environmental due diligence important in commercial real estate?

Environmental due diligence is crucial because it helps identify potential contamination or environmental risks associated with a property. This process typically involves a Phase I Environmental Site Assessment and, if necessary, a more in-depth Phase II assessment. Identifying environmental issues early can prevent costly surprises and potential litigation in the future.

How does demographic analysis factor into commercial real estate due diligence?

Demographic analysis is a key part of market research in commercial real estate due diligence. It involves studying population trends, age distribution, income levels, and other factors that can impact property demand and value. Understanding demographic shifts helps investors predict future market conditions and make informed investment decisions.