Guide to Understanding Commercial Real Estate Deal Structures

When it comes to commercial real estate investing, the majority of properties are acquired through various real estate deal structures that enable a group of investors to aggregate their funds to make a purchase, and understanding the differences between structure types will better enhance your pre-investment due diligence protocol. In this article, we’ll cover, in […]

Real Estate Syndication and Distributions: How Do They Work?

Real Estate Syndication deals have revolutionized how investors raise capital to fund multi-million dollar investment projects. From Entitlement deals to Diversified Single-Family Funds (SFR), syndications have proven to be lucrative and are choice crowdfunding vehicles for business. However, it would be best if you were knowledgeable in understanding the basics of syndications from the deal […]

Diversifying Commercial Real Estate in Houston

Houston, Texas, is recognized as one of the most ethnically diverse cities in the nation. Positioned as the fourth-largest metropolis in the country, Houston has seen an influx of migration due to market growth, job opportunities, and affordable housing. Nevertheless, with the arrival of young professionals and relocating families, neighborhoods recognized as historic African American […]

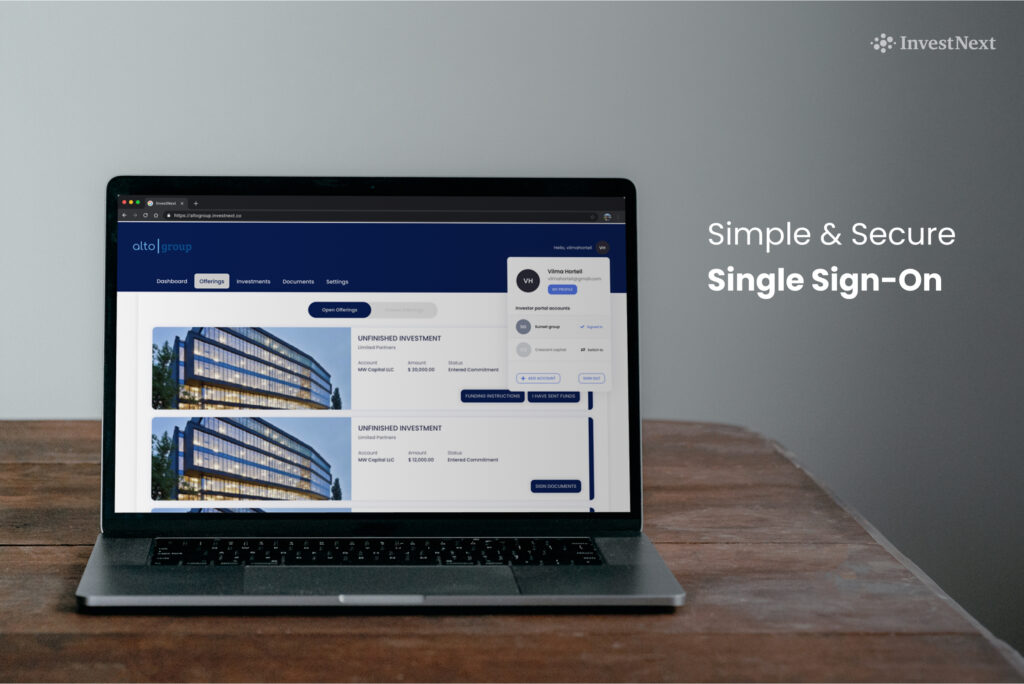

InvestNext Features: Secure and Convenient – Single Sign-On

Super Simple, Super Secure, Single Sign-On We understand that building a strong cybersecurity ecosystem is essential to protecting sensitive data as you access information through the InvestNext portal. With that being said, our team has been working diligently behind the scenes to enhance the security features on our platform. Single sign-on (SSO) authentication is a […]

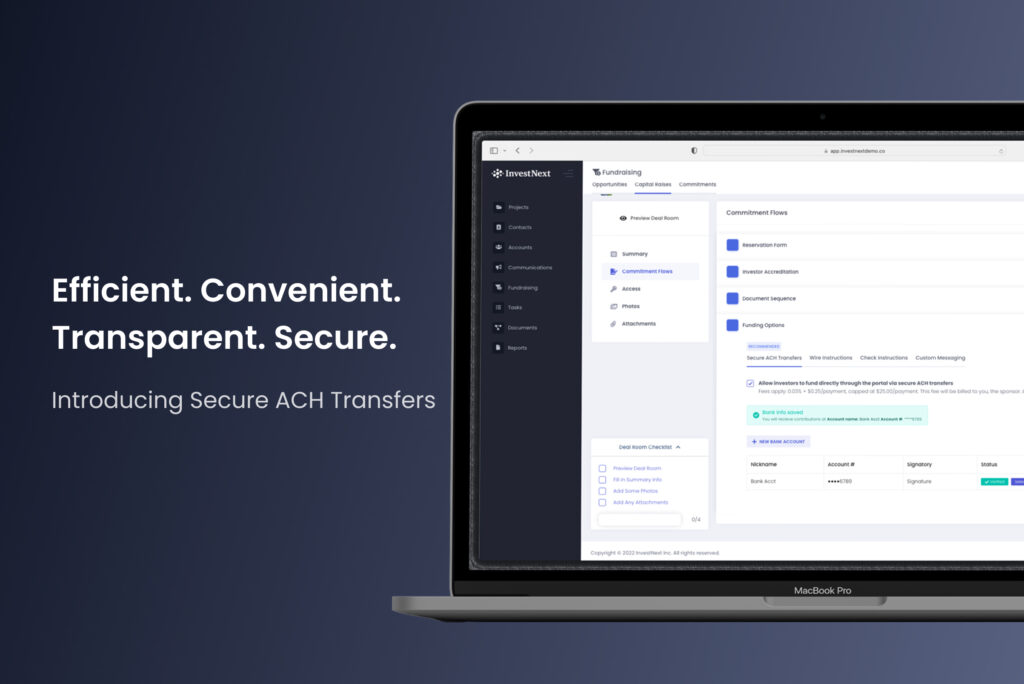

Seal the Deal with InvestNext’s Secure ACH Funding

A significant aspect of preserving investor confidence and obtaining financial commitments is by providing additional safeguards for ACH payment transactions. Investors want reassurance that their resources will be sent directly to the recipient, and as the sponsor, you want to ensure that these transactions are locked in so the deal can be completed successfully. However, […]

What is Value-Add in Commercial Real Estate

Investments in commercial real estate can be grouped into multiple segments that are essentially categorized based on different aspects of the deal. Core (Core Plus), Value Add, and Opportunistic investing strategies are common terms used to describe these areas. Adding value is one of the investment philosophies to follow in the real estate industry when […]

What You Need to Know about Tertiary and Secondary Markets in Commercial Real Estate

Major cities like Los Angeles, New York, Chicago, and D.C. are often the focus of commercial real estate investors due to the fact that these primary markets are the center of commerce and populated hubs that offer excellent opportunities for sizable investments, reducing risk considerably. When it comes to investing in commercial properties, it would […]

Mistakes First-time Syndicators Make When Raising Funds

Experienced syndicators understand that being unprepared for a capital raise can cause friction with investors, lawyers, accountants, and other stakeholders. In this article, we’ll dive into the difference between a stressed, overwhelmed sponsor and a sponsor that enjoys what they do. We’ll also note what mistakes to avoid, how to best manage the syndication process, […]

Capitalizing on Real Estate Syndications in the Face of Recession

It’s no secret that the real estate market is cyclical. What goes up must come down, and vice versa. In a recession, the market for commercial and residential property takes a nosedive. This can be a tough time for investors, who may see their portfolios shrink along with the value of their properties. However, there […]

102 Commercial Real Estate Industry Terms You Should Know

Below is a list of terms that are used regularly in the Real Estate Investing Industry. Capital Raise The process a business goes through in order to raise money, so the business can get off the ground, expand, or transform in some way. In a Syndication, this is typically a raise Investment Portfolio An investment […]