Investing in real estate can be a great way to build wealth over time. However, it’s important to understand the tax implications of your investments.

If you’re new to real estate investing or want to brush up on your tax knowledge, this article will cover the basics of calculating capital gains tax (CGT) on your real estate investment property.

Key takeaways:

- Understanding the types of capital gains tax (short-term, long-term, and depreciation recapture).

- The formula for calculating CGT involves subtracting the adjusted basis from the net sale price and applying the appropriate tax rate.

- Strategies for reducing or deferring CGT include using a 1031 exchange, taking advantage of tax credits and deductions, keeping accurate records, and tax-loss harvesting.

- The Opportunity Zone program allows investors to defer capital gains taxes while contributing to economic redevelopment in low-income areas.

What are Capital Gains

When you sell a capital asset for more than what you initially purchased, the value difference is known as a capital gain. Let’s say you purchased stock 20 years ago for $8,000, and now it’s worth $80,000. The moment you sell the stock, $72,000 is considered a capital gain and will be taxed. Your 20-year investment produced a monetary return that, when sold, counted as a capital gain.

What is a Capital Loss

If an investment is sold for less than its original purchase price, this is known as a capital loss. Capital loss happens when the value of a capital asset, like an investment or real estate, decreases. The loss is only considered real when the asset is sold for less than originally bought.

Capital Gains Tax Definition

When you sell an asset, such as a rental property, you will pay a tax rate on the appreciation of that property. This specific type of tax is known as capital gains because you are taxing the gains on your capital.

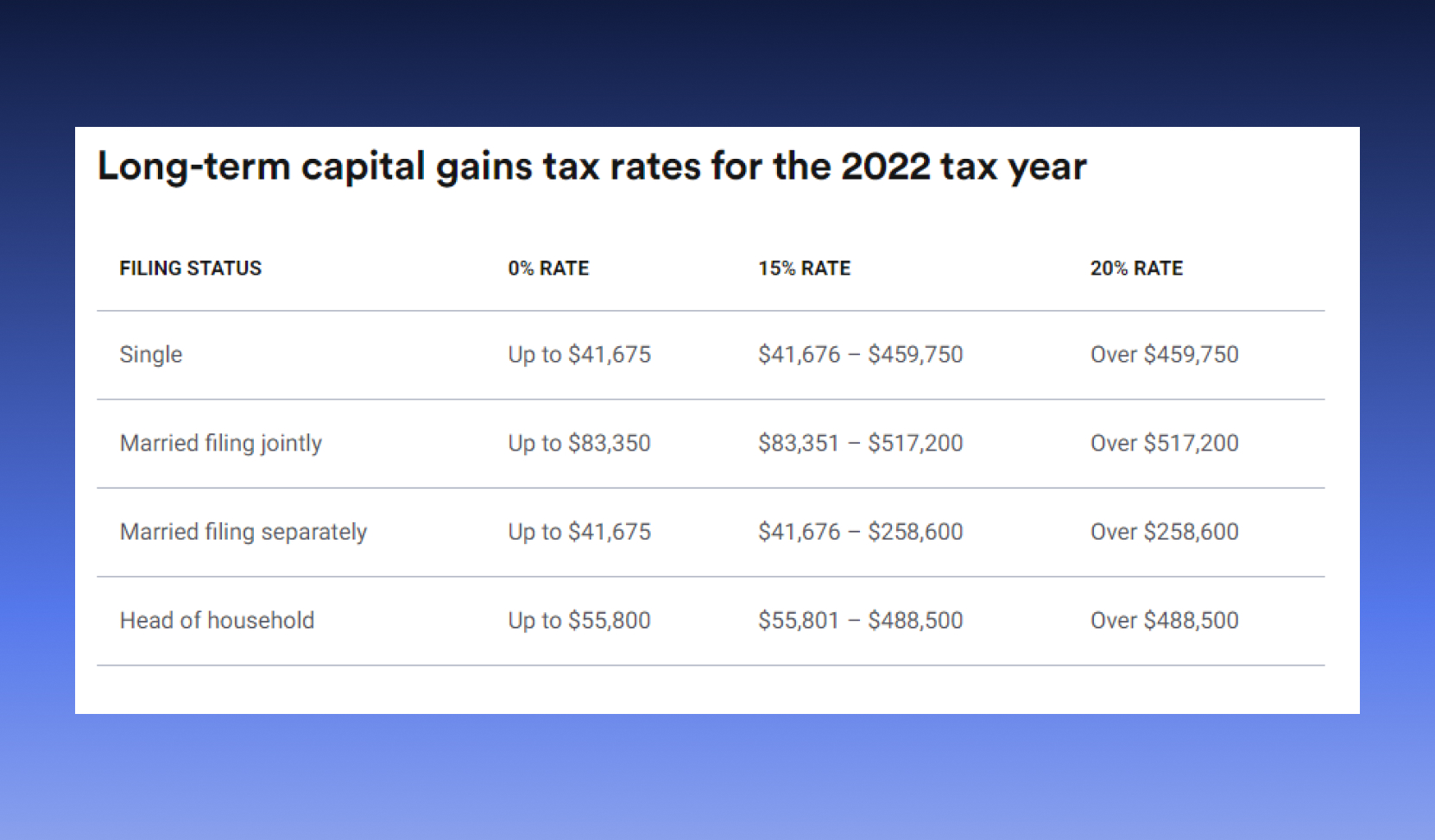

The capital gains tax is an imposition reported on your IRS Schedule D that outlines the profits made by an investor when they sell an investment, and it must be paid in the same tax year as the sale. For the years 2022 and 2023, the long-term capital gains tax rates are 0%, 15%, or 20%, based on the investor’s income bracket, which is updated annually.

Types of Capital Gains Tax

There are different types of capital gains tax. Long-term capital gains tax applies to investments held for more than one year, while short-term capital gains tax applies to those held for a year or less, with the tax rate being higher for short-term gains. We’ll cover more in detail below.

Short-Term Capital Gains Tax

Short-term capital gains tax is the tax levied on profits earned from selling an asset held for less than a year and is also one of the tax implications that you want to avoid having to pay if possible.

This is because it is the highest tax percentage on short-term investments. Thus, you will owe short-term capital gains if you purchase a rental property and sell it within one year. The rates accounted for will range from 10% to 37%.

Long-Term Capital Gains Tax

Long-term gains occur when you sell a rental property more than one year after purchasing it. As stated above, you will pay less tax, typically either 0%, 15%, or 20%, depending on the total gains and your filing status.

Inflation can lead to capital gains, but owning commercial real estate, like manufacturing or self-storage facilities, can serve as a hedge against it. According to a study by MIT, recurring income and property value increases from industrial property can provide a hedge against inflation.

From a personal earnings perspective, the long-term capital gains tax rate is lower than the tax rate for ordinary income. However, the exact percentage of the long-term capital gains tax is determined by the individual’s income and filing status. To better understand the distinction between short-term and long-term capital gains, refer to the following tables for additional information.

Depreciation Recapture Tax

Depreciation recapture tax only occurs in a specific situation where real estate investors choose to depreciate the value of their rental properties to reduce taxable income while owning them. However, if the property is sold for more than its adjusted cost basis after depreciation has been used, a depreciation recapture tax of 25% is applied in addition to the capital gains tax. This is because the IRS seeks to recover the benefits gained from depreciation deductions.

It is worth noting that not all investors will be subject to depreciation recapture tax. This type of tax only applies in specific circumstances where the depreciation technique has been used, but the property is sold for more than its adjusted cost basis. In other words, if the property is sold for less than or equal to its adjusted cost basis, no depreciation recapture tax applies.

The Formula to Calculating Capital Gains Tax

The formula for calculating your capital gains tax is quite simple. Simply subtract your adjusted basis (the price you paid for the property plus adjustments) from your realized amount (what you sold a property for minus any real estate fees). This is the amount you will pay capital gains tax on. Next, follow the IRS instructions to multiply that amount by the correct percentage for your tax status.

For most people, an adjusted basis refers to what you paid for your property. However, with real estate investors, there can be some differences. You would include the cost of acquiring the rental property plus the cost of any capital improvements you made to it, less any casualty loss amounts. Here’s the IRS has a guide to explain the ins and outs of the adjusted basis fully.

How Capital Gains Tax Impacts Real Estate Investing

There are actually a number of ways that capital gains tax impacts real estate investing. When you invest in real estate, you may decide to sell a certain piece of property. If you earn a net profit on that sale, you will want to consider the impact of capital gains tax. Additionally, how long you own a property can affect the amount you pay.

How is Capital Gains Tax Calculated on Real Estate Investment Property?

Now that we understand the definition and types of taxes on capital gains, let’s take a look at how to calculate capital gains tax on your real estate investments.

How to Calculate Your Capital Gains Tax

To calculate capital gains taxes on real estate, you need to subtract the original purchase price, or cost basis, from the net profits obtained from the sale of the property. The cost basis includes expenses such as closing costs, fees, and major improvements made to the property, but routine maintenance and minor repairs do not count.

The net proceeds refer to the amount of money the investor receives after deducting all closing costs and other sale-related expenses from the gross profits. To illustrate, let’s say you sell a real estate investment for $800,000 that you purchased ten years ago. It has an adjusted basis of $350,000. Thus, you have earned $450,000 capital gains on the sale of the property.

Since you held the property for more than one year, you pay long-term capital gains tax (more on this later). You can use tax tables to identify how much you pay in capital gains. In this example, if you are married and filing jointly, you would pay 15%. Thus, your capital gains tax would be $67,500 (15% of $450,000).

Strategies for Reducing or Avoiding Capital Gains Tax on Rental Property

The goal of a real estate investor is to try to reduce the amount of capital gains tax that they will need to pay. Fortunately, there are a few strategies that can help with this.

Deferring Capital Gains Tax with a 1031 Exchange

One effective way to reduce your capital gains tax is to defer it through a 1031 Exchange named after Section 1031 of the IRS code. This option allows you to postpone paying capital gains tax if you reinvest the profits from selling a property into a similar one. The replacement property must be of a similar nature and purpose to the one you sold. For example, if you sold an apartment building, you could purchase a single-family rental home, or if you sold a hotel, you could purchase a shopping center. More specific information on this option is available here.

It is important to note that there are specific timelines associated with a 1031 Exchange. After selling a property, an intermediary receives the funds, and you have 45 days to identify up to three potential properties you intend to purchase. Within 180 days of selling the old property, you must close on one of the proposed properties. During this time, any profits must stay with the intermediary and cannot be accessed by the seller.

A 1031 Exchange is a useful option for deferring capital gains tax on investment properties. However, consulting with a tax professional is important to ensure you comply with all IRS regulations and timelines.

Taking Advantage of Tax Credits & Deductions

You can take advantage of tax credits and deductions to reduce the amount of capital gains tax you owe. To qualify for this exemption, you must have lived in your home for at least two years out of the previous five. If you qualify, you can be exempt from paying capital gains tax on the first $250,000 or $500,000 if filing jointly.

Real estate investors who own rental properties are unlikely to qualify for this exemption since a rental property would not be considered their primary residence. However, there are several tax credits available for investment properties, you can claim deductions on the following:

- Mortgage interest

- Depreciation

- Property taxes (up to $10,000; $5,000 if married filing separately)

- Repairs and other expenses associated with running a rental business

While these tax credits and deductions may not directly reduce your capital gains tax, they can lower your overall tax burden and prove valuable in offsetting your taxes, especially in years with high capital gains.

Keeping Accurate Records

Another essential way to reduce your capital gains tax is to keep accurate records. This is important for proving your financial information and deductions in the event of an audit. Specifically, you need to maintain records on all of the following:

- Purchases of real estate property

- Sales of real estate property

- Documentation of all improvements and repairs, including itemized invoices

Of course, you should already be keeping organized records of all expenses and revenues related to your rental business. Thus, this should not be difficult. If you have any questions about capital gains tax or deductions, consulting a tax professional is always recommended.

Tax-Loss Harvesting

Tax-loss harvesting is a strategy where investors sell underperforming investments at a loss to minimize capital gains taxes. The tax liability can be reduced or eliminated by subtracting capital losses from capital gains. Investors can then reinvest the money from the sold investments in new opportunities.

Capital Gain Taxes and Opportunity Zones

The Opportunity Zones program presents a unique opportunity for investors to defer capital gains taxes while also contributing to the economic redevelopment of low-income areas throughout the United States. By investing in an Opportunity Fund, investors can postpone paying capital gains taxes until the end of 2026, allowing their investments to continue growing tax-free in the meantime.

One of the major benefits of the Opportunity Zones program is that it is not limited to real estate investments. Investors can also reinvest funds from the sale of stock shares, businesses, and other types of investments into an Opportunity Fund. This flexibility allows investors to diversify their investments while still taking advantage of the program’s tax benefits.

Moreover, investors who hold their investments for a minimum of five years prior to Dec. 31, 2026, can take a 10% reduction in their capital gains tax basis, while those who hold their investments for a minimum of seven years can take an additional 5% reduction (for a total of 15%). This reduction can significantly lower an investor’s tax burden and provide additional funds for future investments.

Common FAQs about Capital Gains Taxes on Property

How Does Depreciation Affect Capital Gains Tax?

Depreciation does not offset capital gains but can actually increase the number of capital gains realized on the sale. In addition to normal capital gains taxes, you will pay an additional 25% depreciation recapture tax on the proportion of the gain attributable to depreciation claimed in the past.

Can I Deduct Capital Losses on My Taxes?

Yes, you can deduct capital losses from a rental property on your taxes if you meet certain criteria. In many cases, loss from selling a rental property can be considered a Section 1231 loss, which can be used to reduce any type of income you have – capital gains, wages, or other sources. This is a fairly detailed situation, and it is recommended that you review the specifics.

How is the CGT Calculated on Inherited Property?

Evaluating your CGT on inherited property is a bit more difficult to calculate. This is because you did not pay anything to purchase the property. Thus, the tax is calculated based on the sale price minus the property’s market value on the date of the owner’s death.

Do I Have to Pay Capital Gains Tax if I Sell My Primary Residence?

As noted earlier, you do have to pay capital gains tax if you sell your primary residence. However, if the property was your primary residence for at least two of the five years prior to the sale, you can be exempt from paying capital gains tax on the first $250,000 (or $500,000 if married and filing jointly).

Conclusion

Investing in real estate can provide a great opportunity for wealth-building, but it is crucial to understand the tax implications of these investments. Calculating capital gains tax is an essential part of this process. Different types of capital gains taxes exist, and their rates depend on factors such as the length of time an investor has held a property.

Strategies for reducing or deferring capital gains tax include a 1031 exchange, tax credits, and deductions, keeping accurate records, tax-loss harvesting, and taking advantage of the Opportunity Zones program.

Accurate record-keeping is crucial to prove financial information and deductions in the event of an audit. Ultimately, consulting a tax professional is recommended for advice and guidance on managing capital gains taxes.

Commercial Real Estate Investment Management Software

InvestNext is a full-service investment management platform that allows you to efficiently oversee all aspects of your capital raise in one place. From same-day ACH transactions to waterfall calculations, impress your investors through an intuitive investor portal coupled with stylish deal room functionalities to captivate, attract and retain investors.

Schedule a demo today to see how our team can help you to welcome the next level of raising capital.

InvestNext’s content insights are dedicated to providing educational and informational content only and should not be construed as investment, tax, financial planning, legal, or real estate advice. InvestNext is not acting as an advisor or agent to you. Please seek advice from your own experts in these areas. While InvestNext strives to provide accurate information, we make no representations or warranties about the accuracy or completeness of the information contained in this article.

Additional Commercial Real Estate Resources

How-To Guide on How to Raise Capital For Commercial Real Estate Properties