Fund Administration

Access our industry-leading fund administration partner network. Efficient, accurate, and timely administration for any syndication or fund structure.

Premium quality administration to enable efficient and rapid scaling for your firm.

A fully integrated solution that includes everything you need to raise capital and foster long term relationships with investors.

Create trust and transparency with expert accounting, bookkeeping, and record keeping.

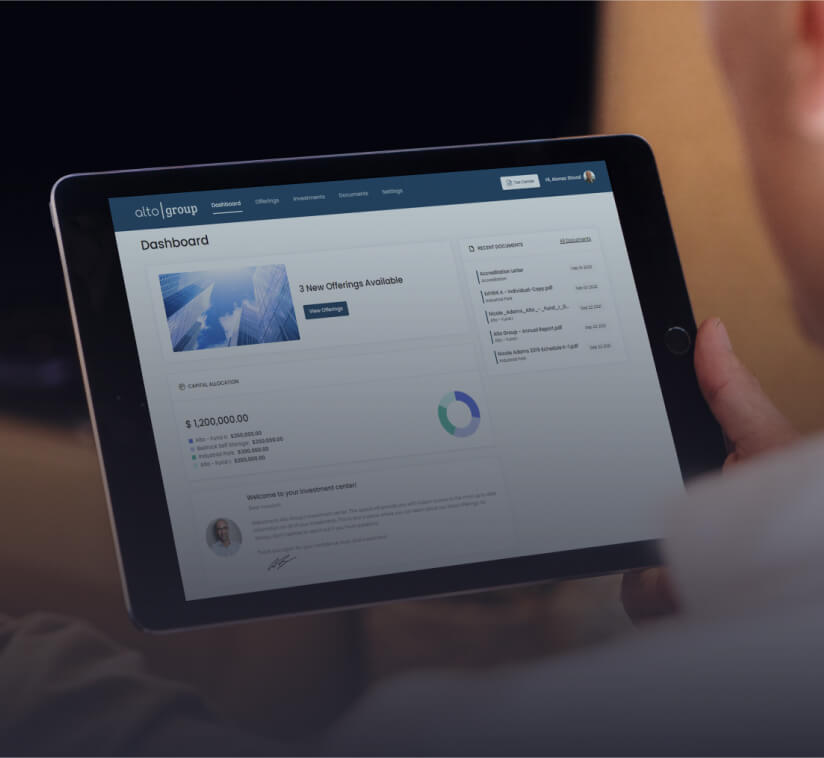

Access modern fund administration within a single environment and leverage fully managed services or augment your existing team. Our expert, premium administration enables flexibility, transparency, and efficiency for small and large sponsors, regardless of your in-house capabilities

Integrate all of your critical functions through a unified platform to save time and reduce complexity, including capital raise management, distribution calculation, payment processing, tax document dissemination, multi-entity consolidation, and financial statement preparation.

Operate confidently with institution-grade processes and documentation. Create trust and transparency with critical, real-time investment data, expert accounting, and record keeping.

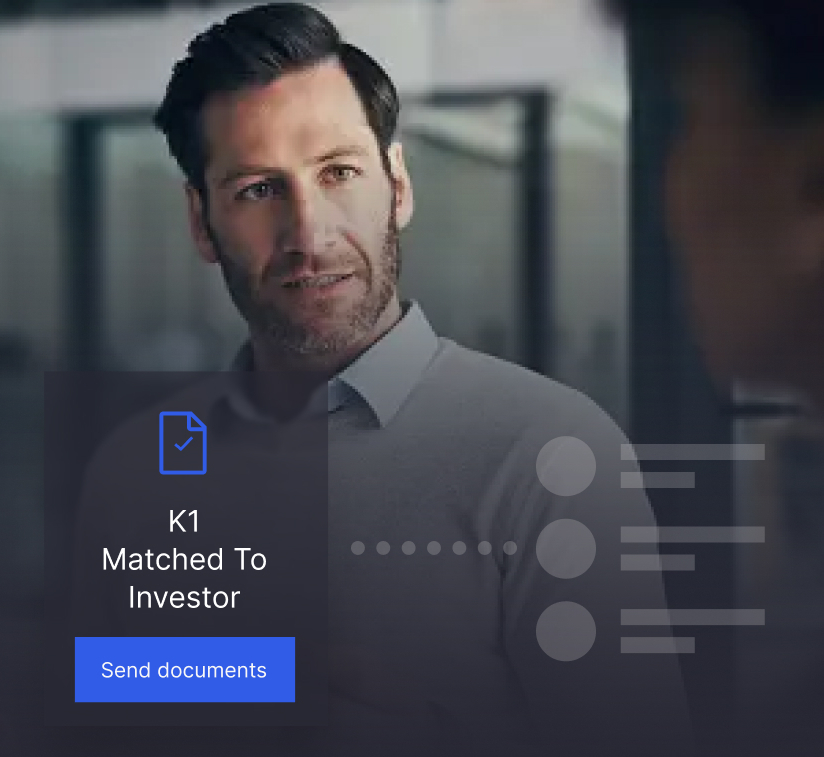

Produce and share K1s and other tax documents in minutes, not days, with streamlined K1 dissemination.

Build credibility and impress your investors with a modern, user-friendly experience. Share documents, send updates, and capture investment intent in a centralized hub.

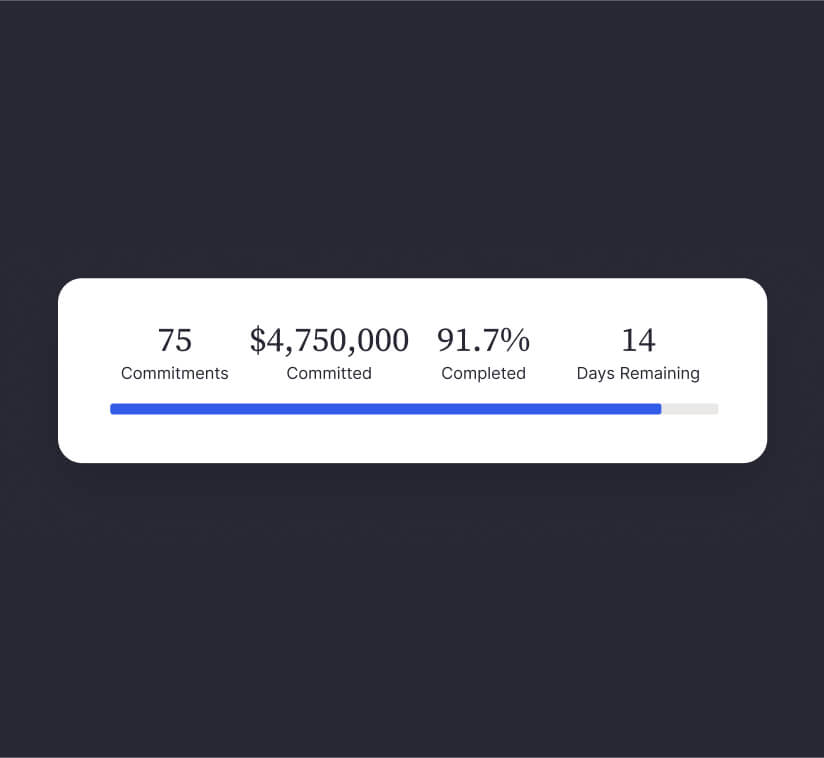

Streamline your fundraising process with engaging deal rooms, frictionless commitment flows, e-signatures, secure inbound funding, automated CRM and back-office integration.

Upgrade to the Real Estate Investment Management Platform

Our analysis reveals the five strategies reshaping CRE capital raising.

Learn how top fund managers are rewriting the rules of engagement.

Drastically reduce the time it takes to raise and distribute capital.

Transform time-intensive processes into powerful and efficient investor relations tools