Security

Keep data secure with the highest industry standards for encryption, data storage, and authentication – verified by strict external audits.

Bank-grade security - backed by externally audited SOC 2 Type 1 and Type 2 certification.

Backed by industry leading SOC2 Type 1 and Type 2 compliance and monthly penetration testing.

Secured with AWS cloud infrastructure with backups and system redundancy.

Technology built with financial institution grade security, leveraging the highest grade encryption (256-bit at encryption-at-rest and TLS/SSL in transit) and authentication standards to keep you and your investors’ data safe.

InvestNext engages in robust external audits and monthly penetration testing to continuously validate our security stack. Our platform is backed by industry leading assessments and is SOC 2 Type 2 certified by the AICPA.

Secure

Secured with AWS cloud infrastructure. We regularly backup your data with a maximum 24-hour RTO and RPO. Built-in system redundancy, 24/7 vulnerability scanning, and uptime monitoring ensures your data is always available and protected.

“InvestNext wasn’t just a tool for me. It was a game-changer in how I managed my portfolio, allowing me to see the bigger picture, analyze data, and diversify investments across various markets, thanks to its versatility.”

Victor Pasaran | Pasago Investment Management

Protect your firm, expand your investor network, and stay compliant with the SEC and other regulatory bodies through fully integrated KYC/AML verification.

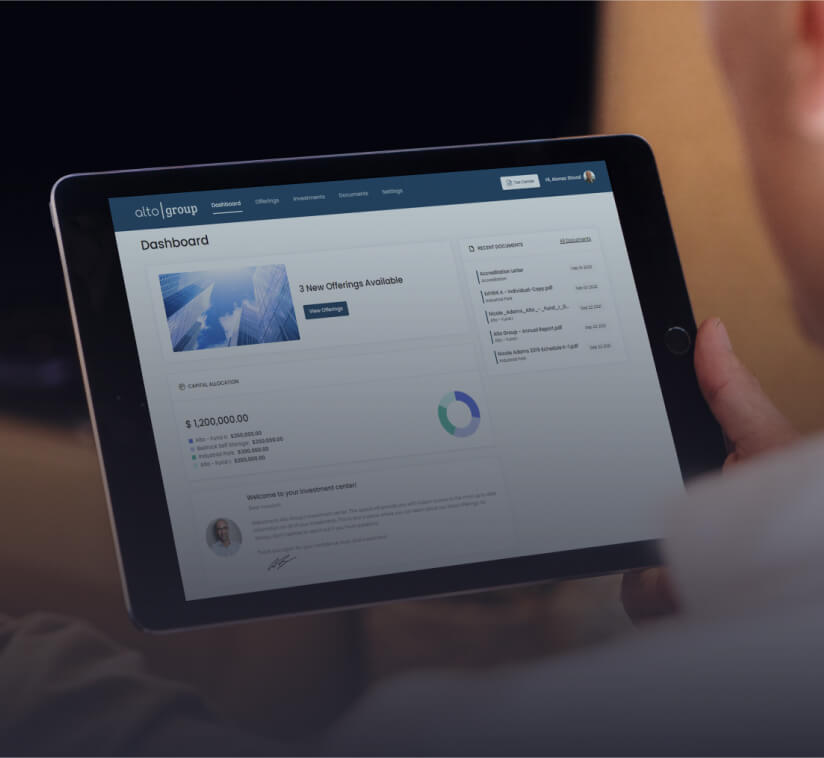

Build credibility and impress your investors with a modern, user-friendly experience. Share documents, send updates, and capture investment intent in a centralized hub.

Reduce administrative overhead with automated financial management.

Our analysis reveals the five strategies reshaping CRE capital raising.

Learn how top fund managers are rewriting the rules of engagement.

Drastically reduce the time it takes to raise and distribute capital.

Transform time-intensive processes into powerful and efficient investor relations tools