Automated Back-Office

Reduce administrative overhead with automated financial management to spend time on your Next Deal. Investor. Opportunity.

Say goodbye to spreadsheets and disparate data sources with a central system of record.

Institution-grade financial management with automated processes designed to help you scale.

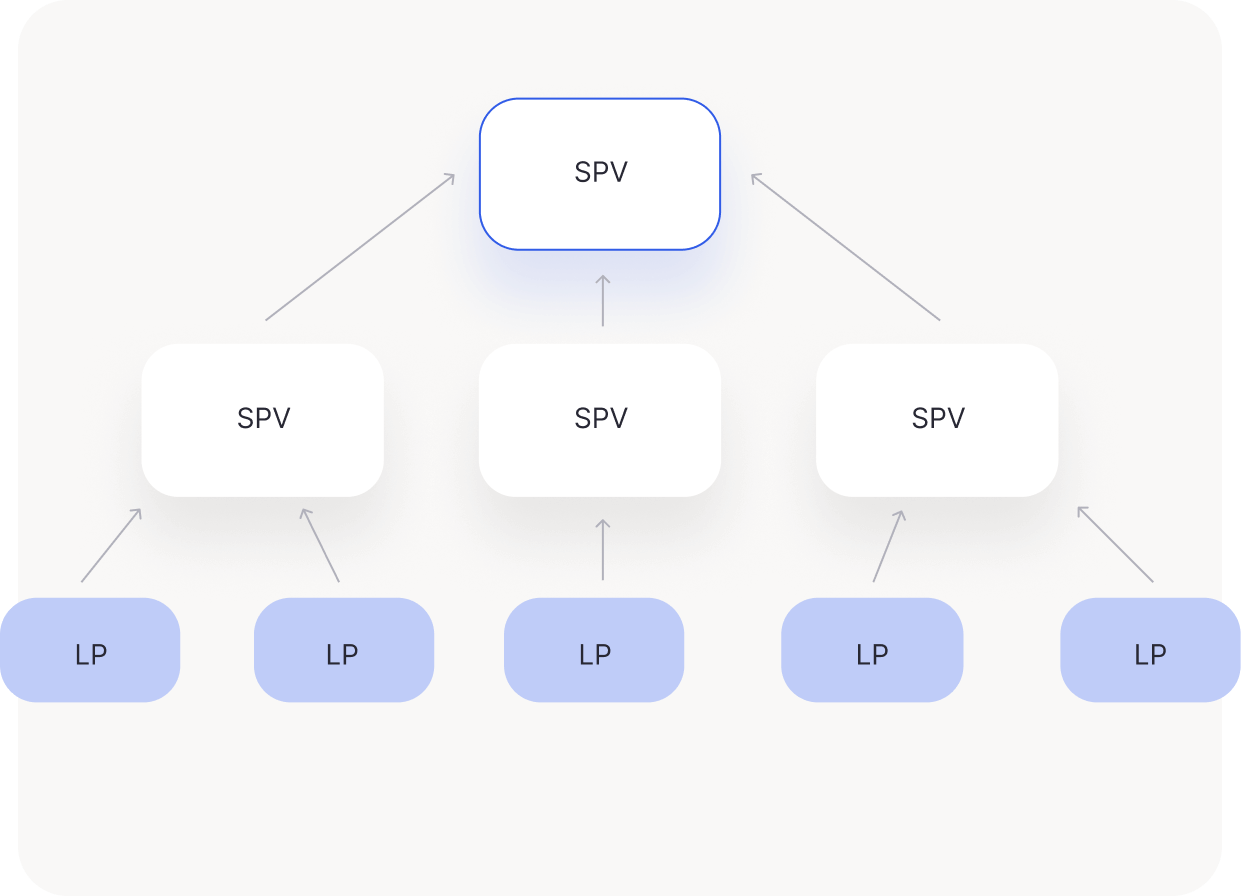

Tailor your business with software support for complex and nested entity structures.

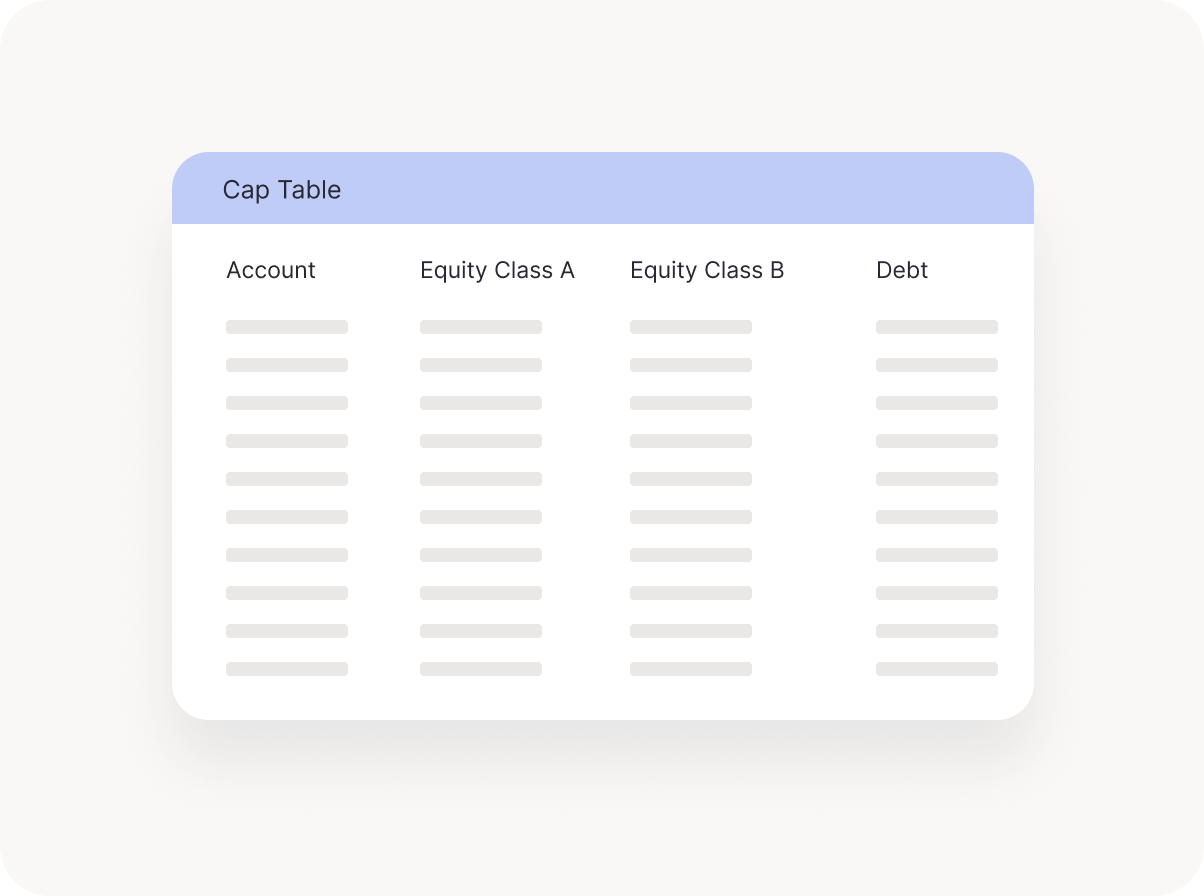

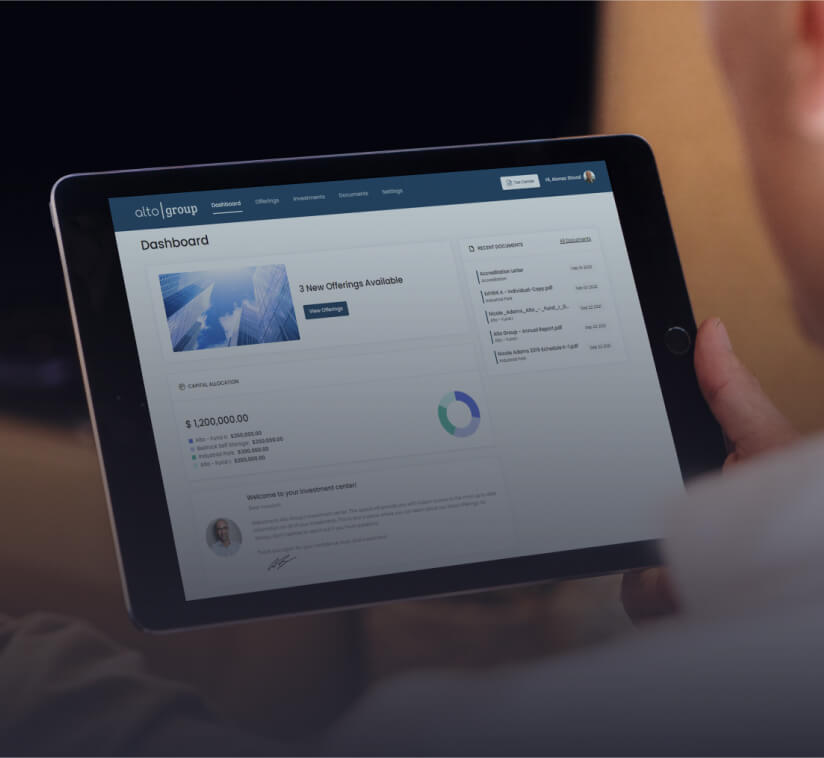

Cap Table Management

Reduce administrative overhead with intelligent systems integration. Automatically create positions in your cap table when investors fund commitments. Sponsor controls enable manual editing and position adjustment for investors who prefer traditional funding methods.

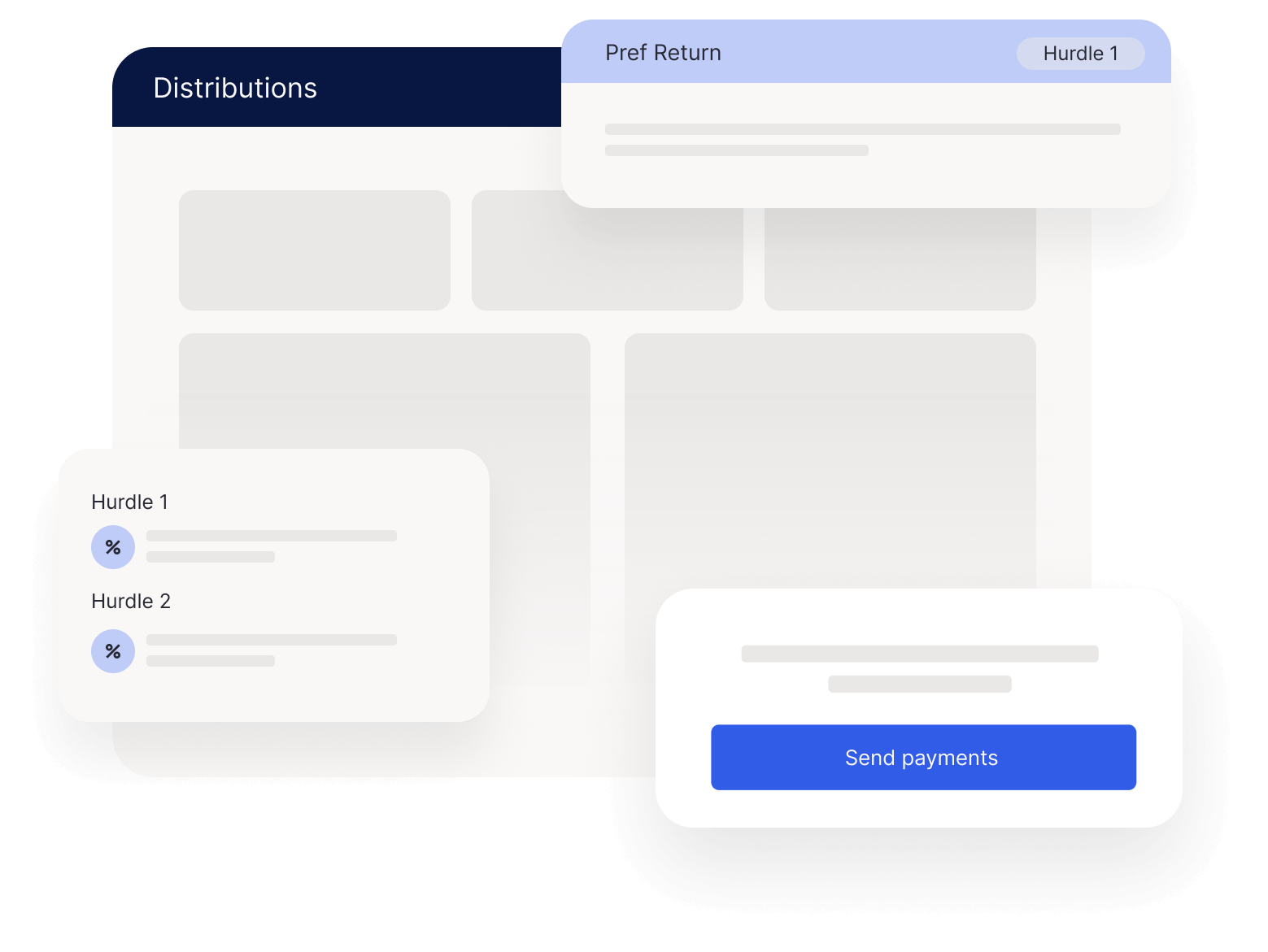

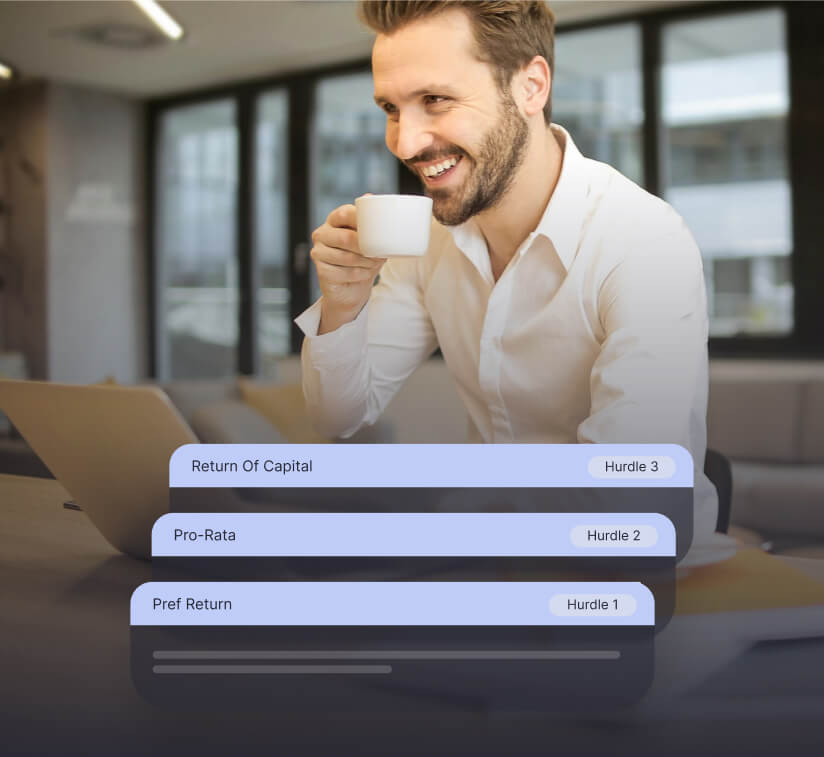

Streamline your distribution process with accurate calculations powered by InvestNext’s automated back-office. Create complex distribution waterfalls, automatically calculate distributions and send secure payments to your investors with a few clicks.

Tailor your entities based on the needs of you and your investors. Leverage back-office functionality designed for multiple equity and debt classes, TIC’s, Fund of Funds, and other complex entity structures.

“Because of InvestNext, we have an institutional-quality investor management software without needing an in-house IT dept or scrimping by creating our own proprietary system.”

Marc Weisi, Head of Acquisitions | Maple Capital Partners

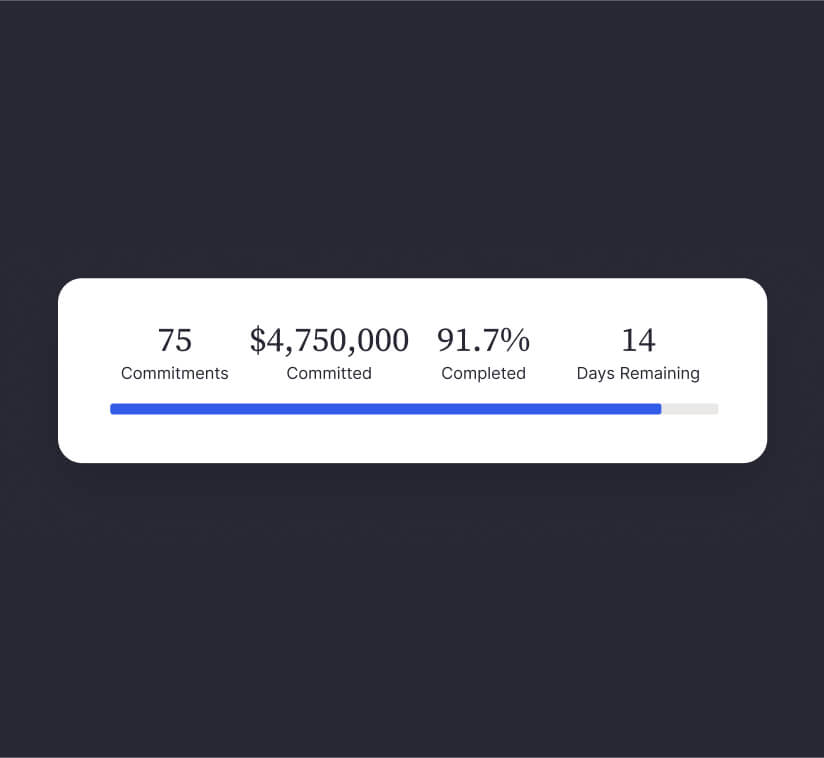

Streamline your fundraising process with engaging deal rooms, frictionless commitment flows, e-signatures, secure inbound funding, automated CRM and back-office integration.

Build credibility and impress your investors with a modern, user-friendly experience. Share documents, send updates, and capture investment intent in a centralized hub.

Create complex distribution waterfalls, automatically calculate distributions and send secure payments to your investors with a few clicks.

Our analysis reveals the five strategies reshaping CRE capital raising.

Learn how top fund managers are rewriting the rules of engagement.

Drastically reduce the time it takes to raise and distribute capital.

Transform time-intensive processes into powerful and efficient investor relations tools