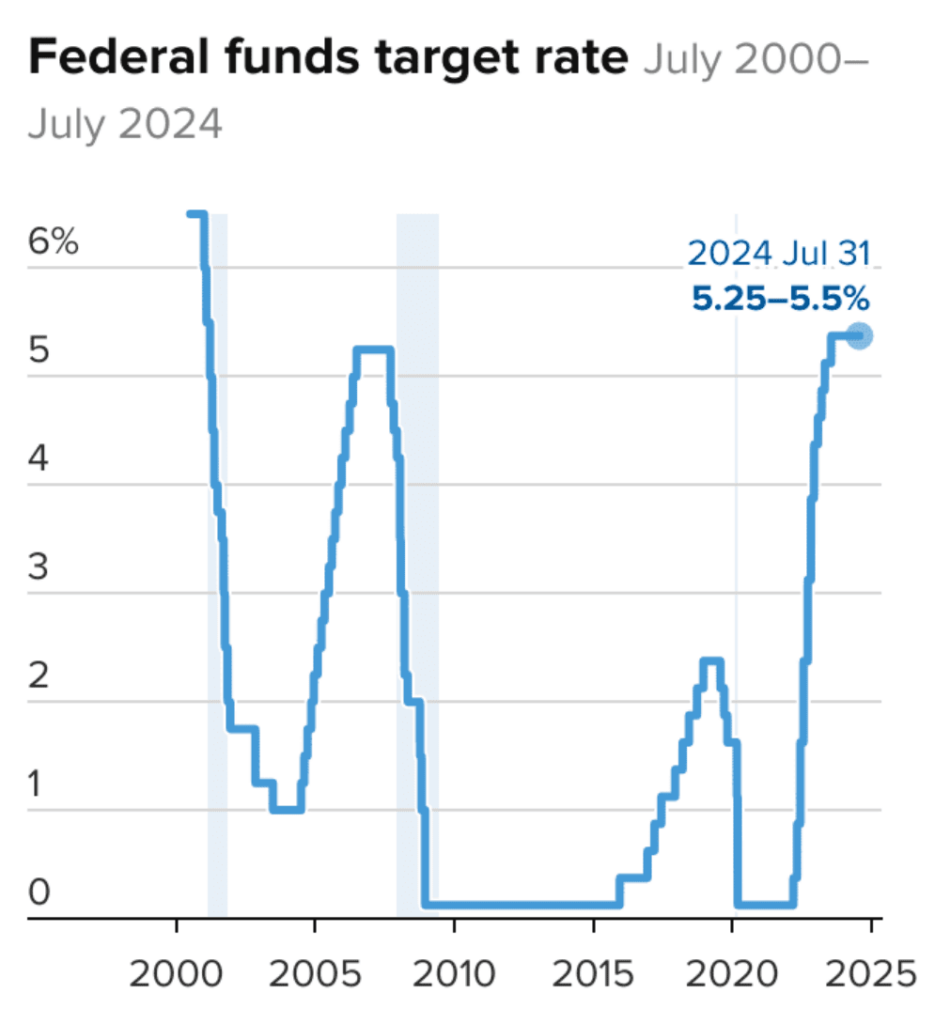

The Federal Reserve maintained its benchmark interest rate at 5.25% to 5.5% on Wednesday but hinted at a possible rate cut in September. Fed Chair Jerome Powell stated that a rate reduction “could be on the table” at the next meeting – signaling a potential shift to a more dovish stance.

The Fed’s statement indicated a more balanced view of risks to employment and inflation goals, suggesting growing concerns about economic slowdown. Markets reacted positively, with stocks rising and bond yields falling.

Impact on Commercial Real Estate

Since no official rate cut was announced, General Partners (GPs) should expect to maintain the status quo while being prepared to pivot in a scenario where rates are cut or stay stagnant.

If there is a policy shift, a rate cut could significantly affect GPs, resulting in:

- Lower borrowing costs may improve financing terms for acquisitions and refinancing.

- Increased transaction activity could create more market opportunities.

- Distressed asset opportunities may arise, with $929 billion in CRE loans maturing in 2024.

- Opportunity to prepare financing strategies for potential rate cuts.

According to CRE Daily, market activity is already picking up due to improved price discovery and the necessity of lower pricing. The approaching loan maturities are contributing to this trend.

While lower rates are generally positive for real estate, investors should remain cautious. The Fed’s consideration of rate cuts partly stems from economic growth concerns, which could impact property fundamentals.

Global Context: Bank of England Takes the Lead

While the Federal Reserve is signaling potential rate cuts, other central banks are already taking action. The Bank of England recently cut its main interest rate by 0.25% to 5%, marking its first reduction in over four years. This decision highlights the global shift towards easing monetary policy.

As commercial real estate is increasingly globally interconnected, these policy shifts can have ripple effects on U.S. markets.

Looking Ahead

As the market approaches this potential inflection point, GPs should be prepared to act swiftly on emerging opportunities while remaining mindful of potential risks. The Fed gradually reduces its balance sheet by shedding Treasury securities, agency debt, and mortgage-backed securities, which may also influence market dynamics.

As the market approaches this potential inflection point, GPs should be prepared to act swiftly on emerging opportunities while remaining mindful of potential risks. The Fed gradually reduces its balance sheet by shedding Treasury securities, agency debt, and mortgage-backed securities, which may also influence market dynamics.

While lower rates are generally positive for real estate, investors should remain cautious. The Fed’s consideration of rate cuts partly stems from economic growth concerns, which could impact property fundamentals. The stock market responded positively to the news, and S&P Futures jumped pre-market on August 1, 2024, but ended the day but tumbled after weak economic data, leading into a bearish turn to end the week.

Lower rates, coupled with over $544 billion in dry powder ready to be deployed, could create a strong acquisition trend for firms as more deals come to the table with over $929 billion in loans coming due this year, leading to a surge in distressed assets reaching maturity and desperately need rescue capital and gap funding.