Sustainable Scale

From $50M to $400M in 4 years: The Open Door Capital Story

The Challenge

Scale operations efficiently while growing Funds Under Management (FUM) without sacrificing investor experience. Manual processes were hindering growth and straining resources.

The Solution

Partner with InvestNext to streamline capital raising, automate complex distributions, and enhance investor engagement through a user-friendly platform.

The Results

- Increased FUM by 700% over 4 years

- Increased distribution management efficiency by 66%

- Enhanced investor relationships by diverting wasted human capital into sourcing more deals

Raise Capital Without Limits

Open Door Capital didn't settle for a partial capital-raising solution. They successfully scaled the firm from $50M to $400M in investor capital under management in just four years on InvestNext.

- Integrated E-signatures

- Secure inbound funding

- Multiple equity & debt classes

- Capital calls

- Support for fund structures

“The introduction of InvestNext came at a critical juncture, providing the scalability we needed to reach $400 million in Capital Under Management within just four years.”

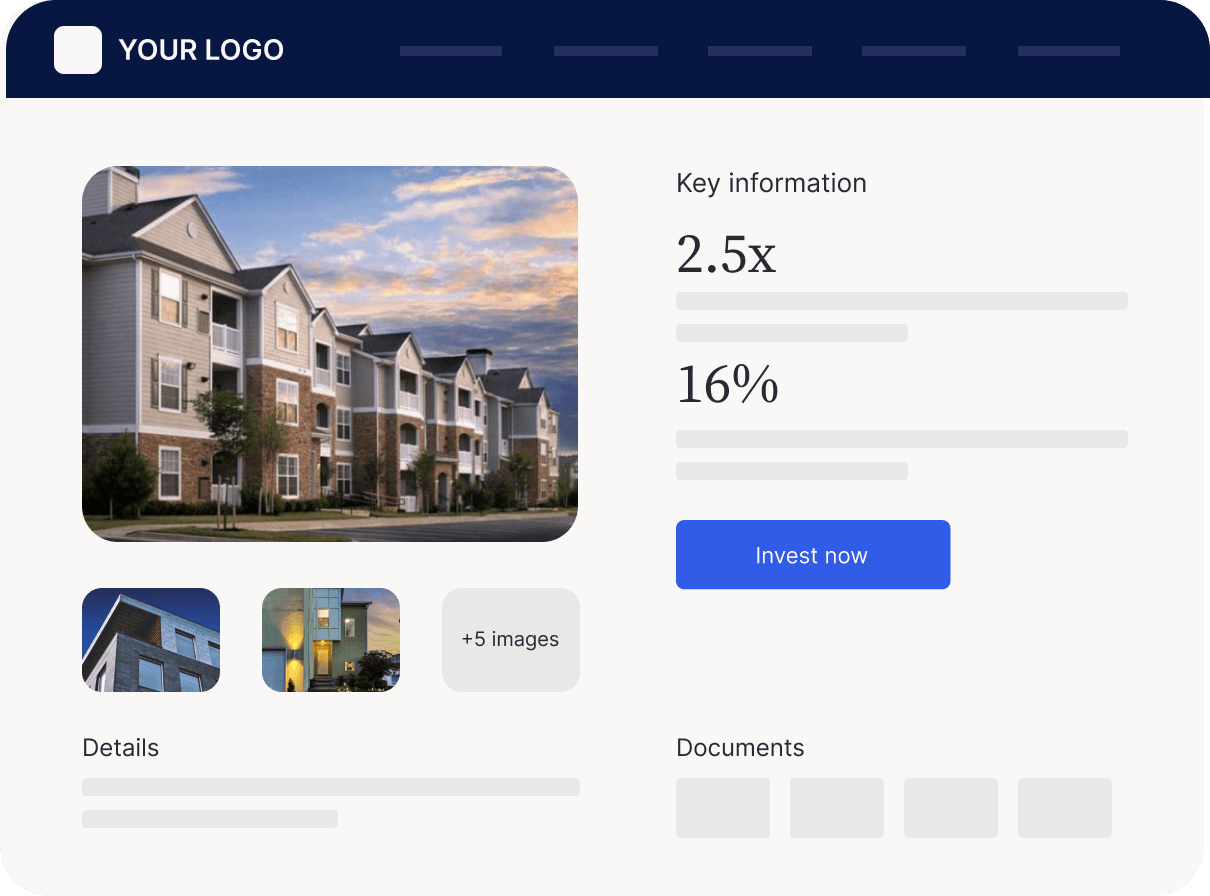

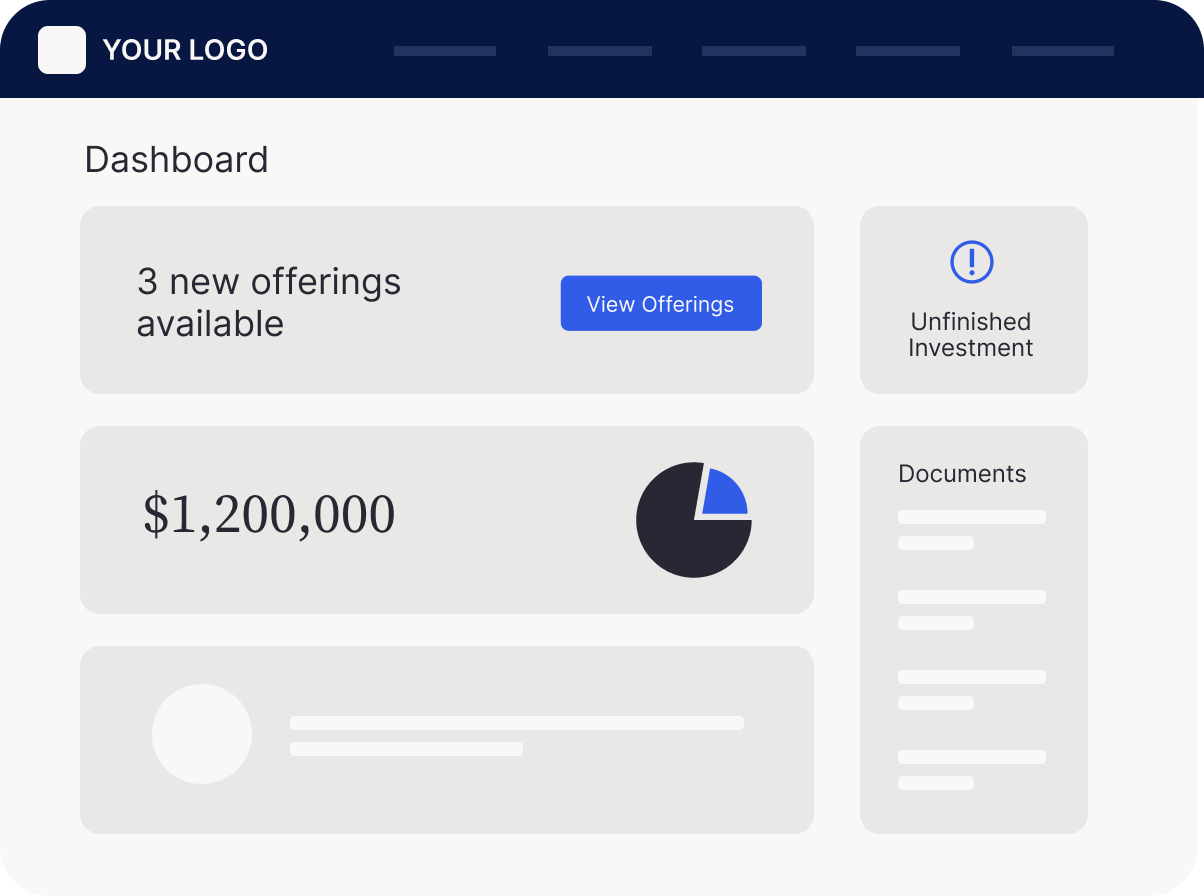

Impress Investors

Open Door Capital created elevated modern transparent user friendly investor experiences for their LPs while enhancing operational efficiency.

- Professional deal rooms

- Anytime access to investment performance

- Secure document sharing

- User-friendly interface

- Personalized communication

- One-click statements

“Our investors found the platform user-friendly and really appreciated the integrated and seamless accreditation processes. For us the Secure ACH feature was incredibly easy to use.”

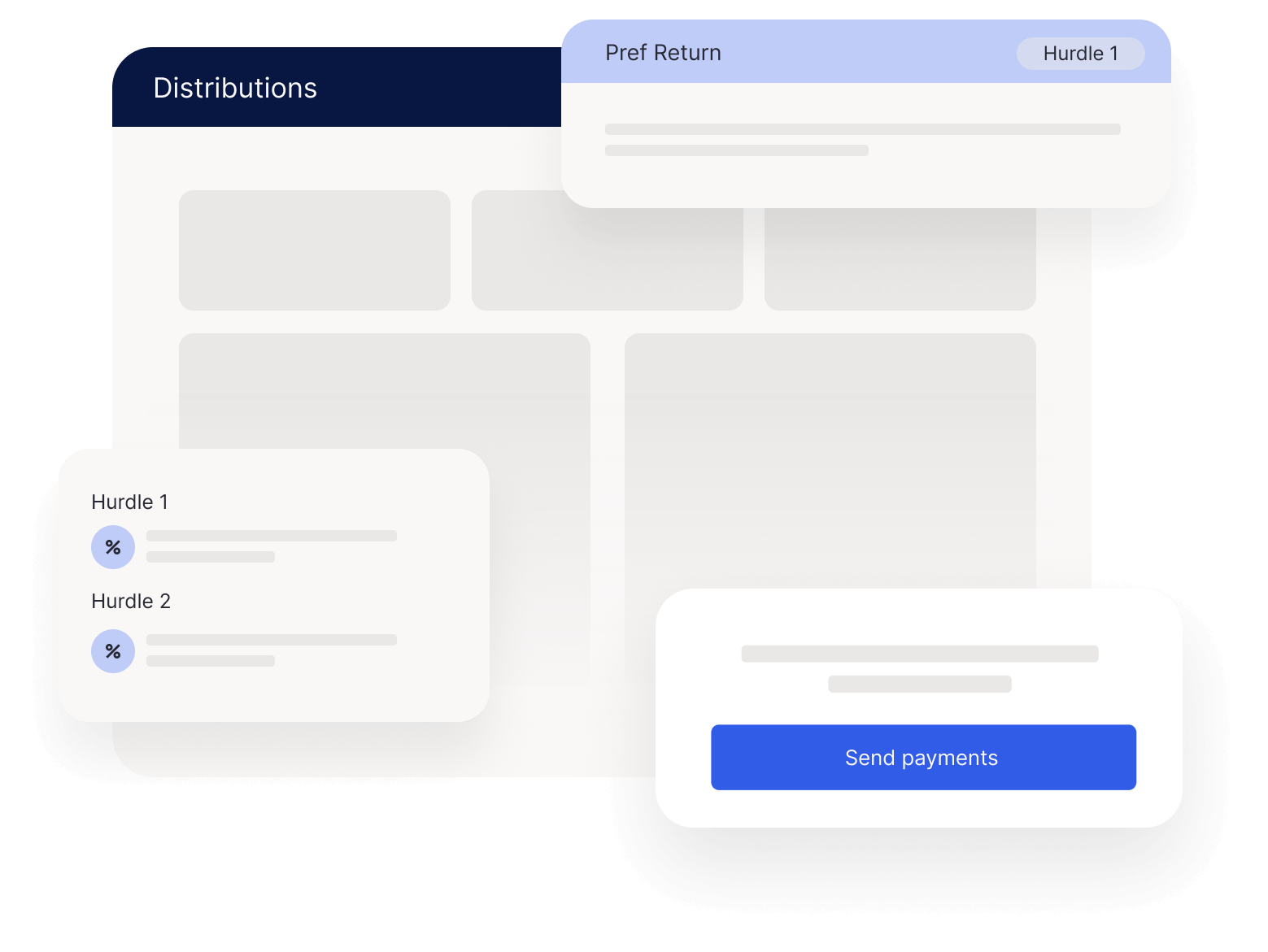

Automate Distributions

Open Door Capital streamlined its operations and distribution processes - removing bottlenecks and creating opportunities for their investor relations team to focus on their Next Deal. Investor. Opportunity.

- Build and excute any operating agreement

- Automatically calculate distributions

- Instantly initiate payments to investors

“InvestNext became the linchpin for our investor interactions. The streamlined distribution process, which had previously been a hurdle, turned into a remarkable time-saving feature. The distribution process used to take 3 team members. Now it takes 1, and it’s only a few clicks.”

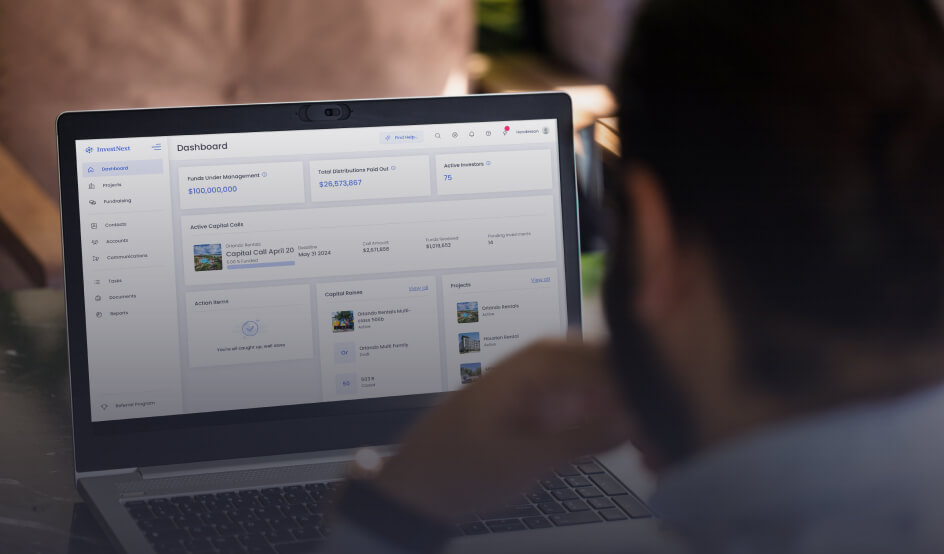

Tools GPs Need Today

Solutions For Tomorrow

By partnering with InvestNext, Open Door Capital had the tools and support they needed to scale their business.

“The feedback loop between the platform and our team and our collaboration with the InvestNext CX team has been instrumental. Constructive input from our users is meticulously gathered and channeled, ensuring it directly influences InvestNext’s development roadmap.”

Scalable Plans.

Simple Pricing.

For Syndicators, General Partners, and Investor Relations Teams.

Plans suitable for any investment size, from initial deals to billion-dollar funds.